Our Board of Directors and Management are committed to maintaining high standards of corporate governance, to protect the interests of our shareholders and other stakeholders. This Report describes our corporate governance practices, with reference to the principles set out in the revised Code of Corporate Governance issued by the Monetary Authority of Singapore on 6 August 2018 (“Code”), for the financial year ended 31 December 2024 (“FY2024”). For FY2024, our Company has complied with the core principles of the Code and also, in all material respects, the provisions that underpin the principles of the Code. Where our practices vary from any provisions of the Code, these variations are identified together with an explanation of the reason for the variation and an explanation on how our practices are consistent with the intent of the relevant principle.

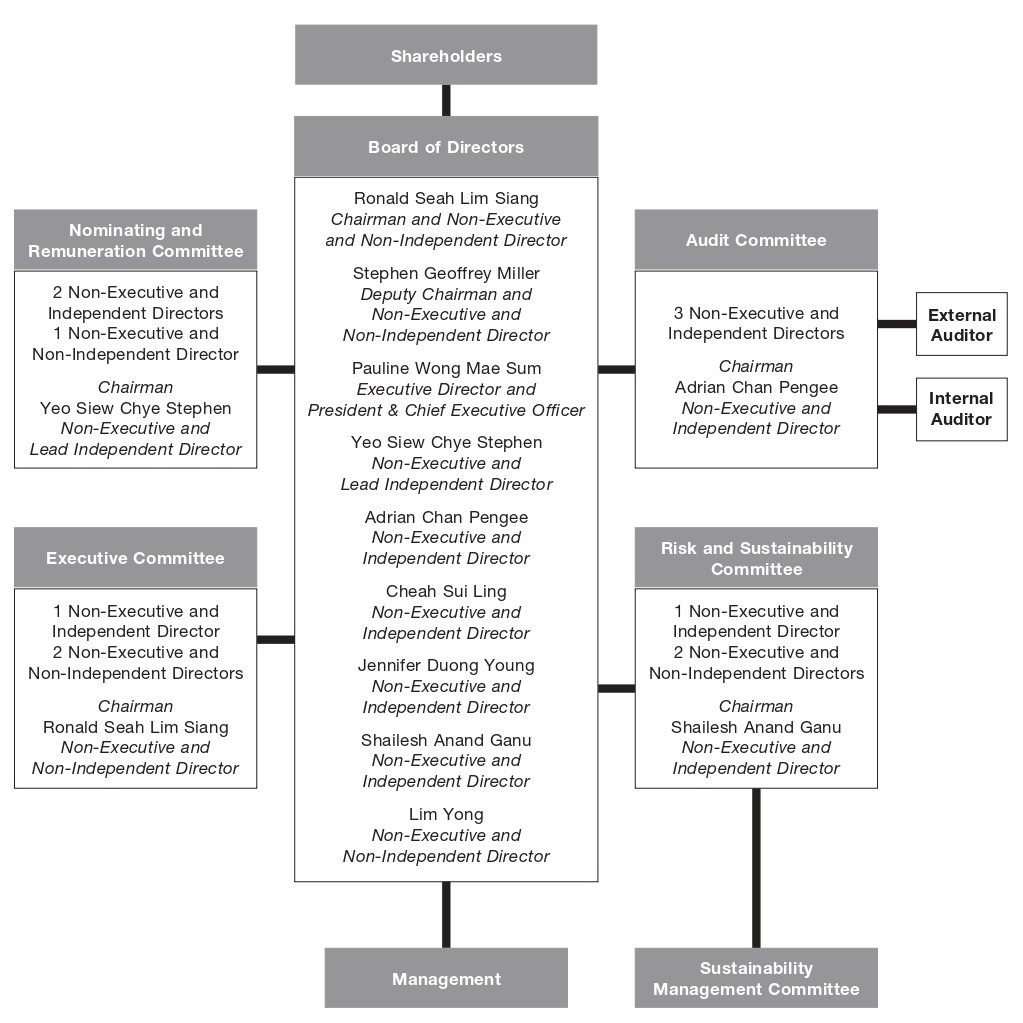

CORPORATE GOVERNANCE FRAMEWORK

(A) Board Matters

Principle 1: Board’s Conduct of its Affairs

The company is headed by an effective Board which is collectively responsible and works with Management for the long-term success of the company.

Role of our Board

Our Board is collectively responsible for, and works with Management to achieve, the long-term success of our Company and value creation for our shareholders. Our Board is responsible for guiding our overall strategic direction, corporate governance, setting organisational culture and providing oversight in the proper conduct of the business of our Company and our subsidiaries (“Group”). Our Board supervises the achievement of Management’s performance targets which align the interests of our Board and Management with that of the shareholders, whilst balancing the interests of all shareholders. Our Board also sets the tone for our Group in respect of organisational culture and values, and ensures proper accountability within our Group. Our Company has in place an internal Code of Business Conduct and Ethics which sets out the professional and ethical framework to guide our behaviour and within which business decisions should be made at our Company, as well as a Whistleblowing Policy and an Anti-Corruption Policy. Please also refer to the sections “Code of Business Conduct and Ethics”, “Whistleblowing Policy” and “Anti-Corruption Policy” on pages 58 to 59 for further information.

Discharge of duties

All Directors are fiduciaries and required to act objectively in the best interests of our Company at all times. Any Director who is in any way, directly or indirectly, interested in a transaction or proposed transaction with our Group is required to declare the nature of his or her interest in accordance with our Constitution and the provisions of the Companies Act 1967 (“Companies Act”). If any Director faces any actual or potential conflict of interests in relation to any matter under discussion or consideration by our Board or Board Committee, he or she is required to immediately declare his or her interest and recuse from participating in the deliberation and abstain from decision-making on such matter, with such abstention being recorded in the minutes and/or the resolutions of our Board and/or relevant Board Committee.

Board approval

Our Company has adopted internal guidelines on the matters that require the approval of our Board, which are communicated to Management. Key matters that require Board approval include the following:

- Strategic direction of our Group

- Corporate strategies and policies

- Annual operating and capital budgets of our Group

- Release of business performance updates for first and third quarters

- Release of half-year and full-year financial results

- Annual report and financial statements

- Convening of shareholders’ meetings

- Recommendations of dividend payments and other distributions to shareholders

- Issue of shares

- Material acquisitions and disposals of assets

- Capital and operating expenditure above specified limits

- Investments and divestments above specified limits

- Interested person transactions

- Board assurance framework

- Banking facilities

- Sustainability reporting

For operational efficiency, our Board has put in place a delegation of authority matrix that sets out the delegated authority to different levels of Management for capital and operating expenditure, investments and divestments, bank borrowings and cheque signatories arrangements, subject to pre-determined limits. Such delegation of authority matrix is reviewed by our Board and, if necessary, updated from time to time to ensure continuing relevance and effectiveness in the context of the internal controls implemented by our Company.

Board Committees

Our Board has established different Board Committees to assist it in the discharge of its functions.

Our Board has established an Executive Committee (“EC”) to oversee major business and operational matters. Management regularly consults and updates our EC on all major business and operational issues.

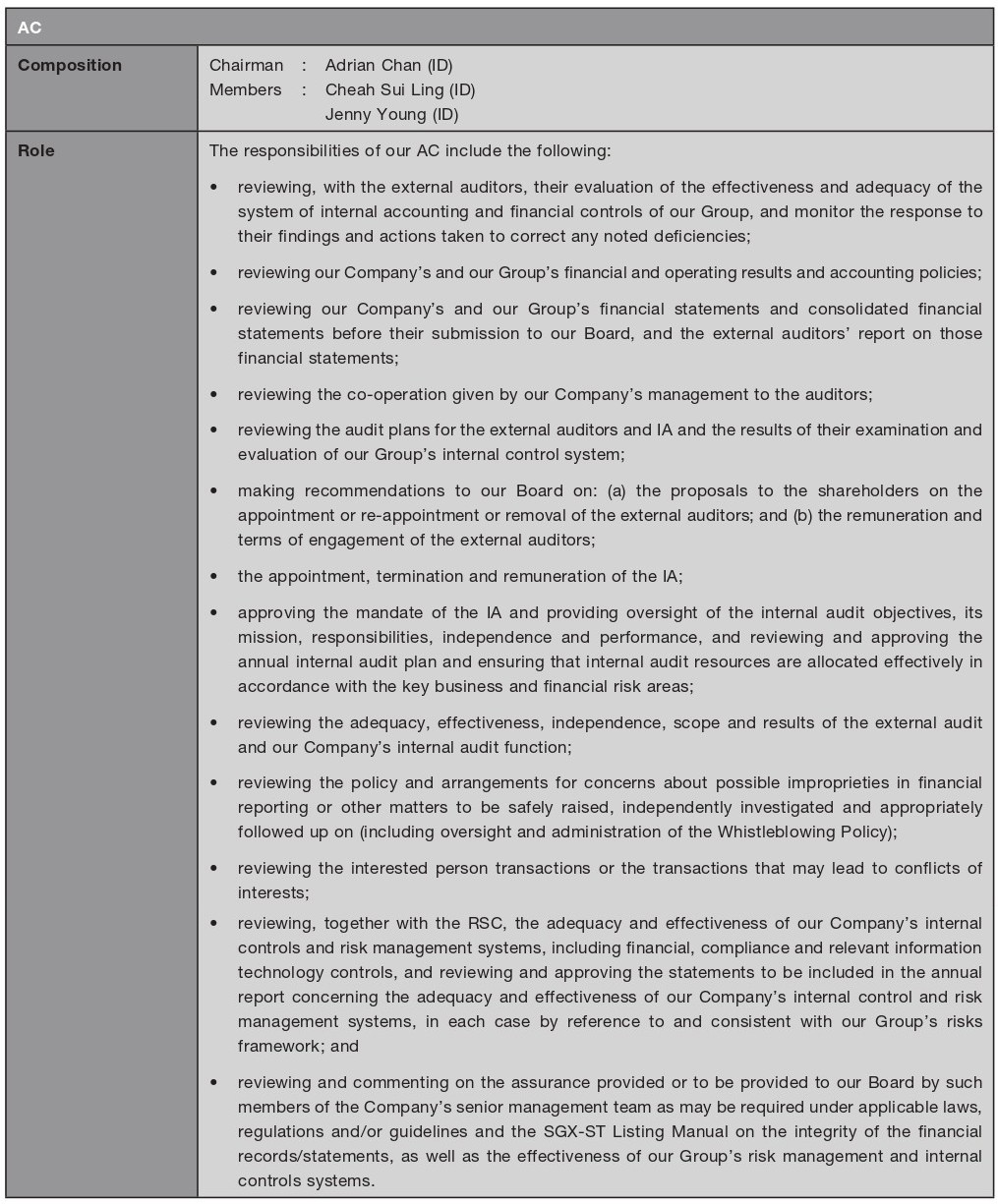

Our Board is also supported by other Board Committees which are delegated with specific responsibilities, being the Audit Committee (“AC”), the Risk and Sustainability Committee (“RSC”) and the Nominating and Remuneration Committee (“NRC”). The RSC was established by our Board as a new committee in FY2023 with a view to having a more holistic view of, and integrated approach to, managing sustainability and the governance of risks. The NRC was formed in April 2024 from the combination of the previous Nominating Committee and Remuneration Committee, in order to streamline the structure of the Board Committees and to achieve greater efficiency.

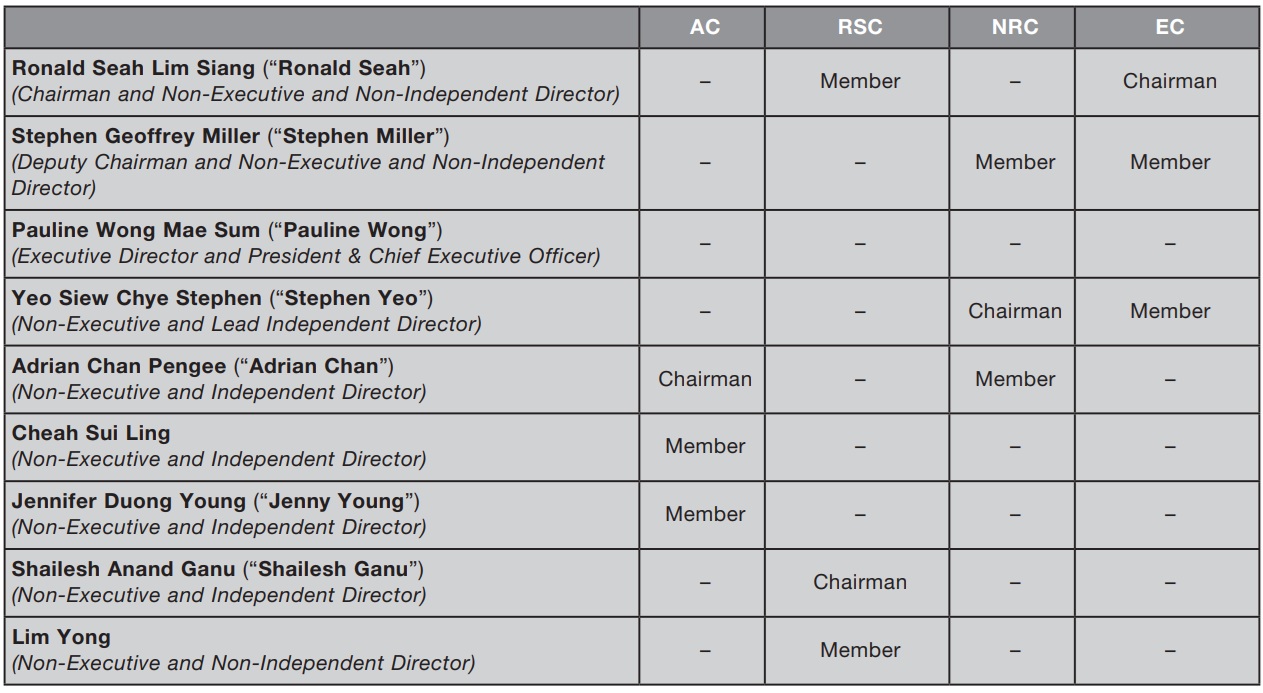

The current composition of our Board Committees is as follows:

Each of our Board Committees has its own written terms of reference that set out its authority and duties. The terms of reference are reviewed on an annual basis and, if required, updated accordingly. The terms of reference, and any amendments thereto, are subject to the approval of our Board. The Chairman of each Board Committee will report on the decisions and significant matters discussed at the Board Committee meeting to our Board at the next Board meeting, and minutes of each Board Committee are also circulated to the full Board for information.

The delegation of authority to these Board Committees to review, determine and make recommendations on matters within their respective terms of reference, with each Board Committee reporting back to our Board on the proceedings of each meeting, promotes efficient working of our Board without abdicating our Board’s overall responsibility.

A description of, among other things, the duties and activities of our Board Committees is set out under:

- in respect of the NRC, “Principle 4: Board Membership”, “Principle 5: Board Performance”, “Principle 6: Procedures for Developing Remuneration Policies” and “Principle 7: Level and Mix of Remuneration”;

- in respect of the RSC, “Principle 9: Risk Management and Internal Controls”; and

- in respect of the AC, “Principle 10: Audit Committee”.

Board orientation and training

Our Board implements measures with a view to ensuring that both newly appointed as well as existing Directors are familiar with our Group’s business and operations as well as their duties and responsibilities as directors.

Orientation and induction for New Directors

In relation to new Directors, we implement a formal orientation framework to familiarise them with our Group and their duties and responsibilities as Directors. Our practice is to issue a letter of appointment setting out their duties and obligations as Executive Director (“ED”), Non-Executive and Non-Independent Directors (“Non-IDs”) or Non-Executive and Independent Directors (“IDs”) (as the case may be) to formalise their appointment. New Directors are given briefings by Management on (among other things) the business activities, performance and strategic directions of our Group. New Directors are also provided with relevant documentation relating to our Group, including manuals containing, among others, relevant information on our Group and information about their statutory and other responsibilities as Directors, and minutes of past meetings of our Board and Board Committees.

A new Director who has no prior experience as a director of a listed company will be briefed by our Company Secretary on the duties and responsibilities of a director of a listed company, the principal laws and regulations applicable to a listed company as well as our Board processes and practices. Newly appointed Directors with no prior experience as directors of a listed company will also be required to attend relevant training as prescribed by the SGX-ST Listing Manual (“Listing Manual”) unless our NRC assesses that training is not required because that Director has other relevant experience (in which event the basis of such assessment will be disclosed).

New Directors appointed during FY2024

During FY2024, Adrian Chan and Jenny Young were appointed as IDs. They were provided with briefings from Management on our Group’s objectives, strategic directions, key business strategies and plans, operational activities and processes. Adrian Chan has many years of experience as a director of listed companies. As Jenny Young has no prior experience as a director of a listed company, she was briefed on the duties and responsibilities of a director of a listed company, the principal laws and regulations applicable to a listed company and Board processes and practices. Jenny Young has also attended the relevant courses conducted by the Singapore Institute of Directors (“SID”) as prescribed by the Listing Manual within one year of her appointment.

Continuous training and development

On an ongoing basis, our Board as a whole is kept up-to-date on pertinent developments in our Group’s business and operations, as well as the industry and legal and regulatory environment in which our Group operates. In particular, Management monitors changes to regulations and accounting standards closely. Updates and briefings on regulatory requirements are conducted either during Board sessions or by circulation of papers. Directors are also encouraged to attend seminars and training (including those conducted by the SID in conjunction with SGX-ST) that may be relevant to their duties and responsibilities as directors, at our Company’s cost, to continually develop and refresh their professional knowledge and skills and to keep themselves abreast of relevant developments in our Group’s business and the regulatory and industry-specific environments in which our Group operates. This enables our Directors to serve effectively and contribute to our Board. Our Directors are regularly provided with a list of upcoming seminars and trainings conducted by the SID and/or SGX-ST.

Board and Board Committee Meetings

Our Board meets regularly to review our key activities and business strategies. Regular Board meetings are held quarterly to deliberate on strategic matters and policies, including significant acquisitions and disposals, the annual budget, review the performance of the business and approve the release of the first quarter and third quarter business performance updates and half-year and full-year financial results. In addition to the quarterly meetings, our Board will also meet towards the end of each financial year to deliberate on the business strategy for the following financial year. Where necessary, we convene additional Board sessions to address significant transactions or developments.

Our Board Committees meet on a regular basis and additional meetings are convened as and when required. In particular, our AC meets on a quarterly basis to deliberate, among other things, the first and third quarter business performance updates and half-year and full-year financial results.

The schedule for regular meetings of our Board and Board Committees and the annual general meeting (“AGM”) for each financial year are determined and notified to all Directors before the start of that financial year, so that our Directors can arrange their schedules accordingly. To facilitate attendance, a Director who is not able to be physically present may attend any Board or Board Committee meeting by way of teleconference or videoconference. If a physical Board meeting is not possible, timely communication with members of our Board is effected through electronic means, which include electronic mail, teleconference and/or videoconference. Where necessary, Management will arrange to brief each Director, before seeking our Board’s approval.

All Directors participate actively in our Board and Board Committee meetings, including where appropriate questioning assumptions, challenging Management and offering alternative views. Consensus is achieved and decisions are made after open, constructive and meaningful debate and discussion.

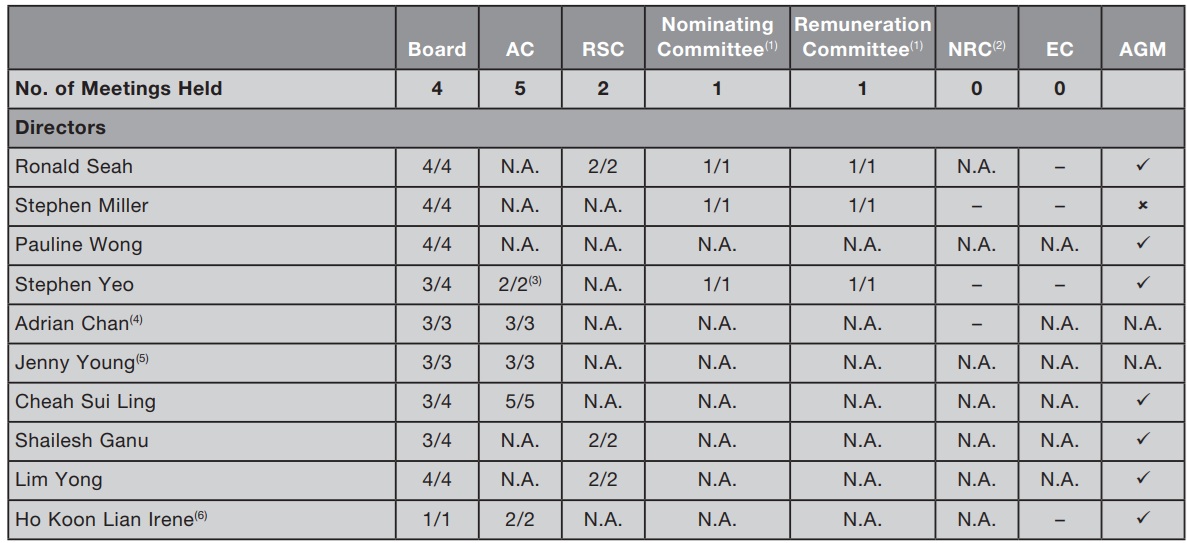

Details of frequency and participation at our Board, AC, RSC, NRC and EC and general meetings for FY2024 are set out in Table 1.

Table 1: FY2024 – Directors’ Attendance at Board, Board Committees and AGM

Notes:

- The NRC was formed in April 2024 from the combination of the previous Nominating Committee and Remuneration Committee, following which the Nominating Committee and Remuneration Committee were dissolved. Prior to the formation of the combined NRC in April 2024, the Nominating Committee and Remuneration Committee had the same members, i.e. Ronald Seah as Chairman, and Stephen Miller and Stephen Yeo as members. In FY2024, one (1) Nominating Committee meeting and one (1) Remuneration Committee meeting were held, which were attended by all members of Nominating Committee and Remuneration Committee.

- The NRC was constituted in April 2024 with Stephen Yeo as Chairman, and Stephen Miller and Adrian Chan as members. No NRC meeting was held in FY2024.

- With the appointment of Adrian Chan and Jenny Young as Directors and members of our AC on 24 April 2024, Stephen Yeo stepped down as an AC member on 24 April 2024. The disclosure of “2/2” reflects that two (2) AC meetings were held during the period when he was an AC member and that he had attended both meetings.

- Adrian Chan was appointed as a Director and Chairman of our AC on 24 April 2024. The disclosure of “3/3” in relation to attendance at Board meetings reflects that three (3) Board meetings were held after his appointment and he had attended all three (3) Board meetings. The disclosure of “3/3” in relation to attendance at AC meetings reflects that three (3) AC meetings were held after his appointment and he had attended all three (3) AC meetings.

- Jenny Young was appointed as a Director and a member of our AC on 24 April 2024. The disclosure of “3/3” in relation to attendance at Board meetings reflects that three (3) Board meetings were held after her appointment and she had attended all three (3) Board meetings. The disclosure of “3/3” in relation to attendance at AC meetings reflects that three (3) AC meetings were held after her appointment and she had attended all three (3) AC meetings.

- Ho Koon Lian Irene resigned as a Director and a member of our AC on 24 April 2024. The disclosure of “1/1” in relation to attendance at Board meetings reflects that one (1) Board meeting was held prior to her resignation and she had attended that Board meeting. The disclosure of “2/2” in relation to attendance at AC meetings reflects that two (2) AC meetings were held prior to her resignation and she had attended both AC meetings.

Access to information

We recognise the importance of the provision of complete, adequate and timely information relating to our Group to our Board in order to enable our Directors to make informed decisions and discharge their duties and responsibilities. Management provides our Directors with monthly business and financial reports that include updates on our key operational activities and financial performance, a comparison of our actual performance with budget, and highlighting key business indicators and major issues that are relevant to our performance, position and prospects. The monthly flow of information and reports allows our Directors to make informed decisions and also to keep abreast of key challenges and opportunities between our Board meetings.

The agenda and Board papers for Board and Board Committee meetings are circulated to our Directors in advance to facilitate review and preparation for the Board meetings. During the quarterly Board meetings, Management will typically provide our Board with an update on our Group’s business and operations in the relevant quarter, the financial performance and variance from budget for that quarter, and any other significant matters or issues that may have arisen. This provides our Board with continuous oversight of the progress of our business and financial performance throughout the financial year, and also an opportunity for active engagement between our Board and Management.

Aside from Board meetings, frequent dialogue takes place between Management and members of our Board, and our ED and President & Chief Executive Officer (“President & CEO”) encourages all Directors to interact directly with all members of our Management team.

Access to Management, Company Secretary and Independent Advisers

Our Board has separate and independent access to our Management and the Company Secretary at all times and is free to conduct independent or collective discussions with Management and the Company Secretary. The Company Secretary supports our Board to ensure its proper functioning, including by attending to corporate secretarial administration matters and providing advice to our Board and Management on corporate matters. The Company Secretary attends all Board meetings and assists the Board Chairman in ensuring that Board procedures are followed. The appointment and removal of the Company Secretary are subject to the approval of our Board. Our Directors may, in their discretion, seek independent professional advice, if necessary, at our Company’s expense on any area of interest or concern.

Principle 2: Board Composition and Guidance

The Board has an appropriate level of independence and diversity of thought and background in its composition to enable it to make decisions in the best interests of the company

Board composition

Prior to the change in the composition of our Board on 24 April 2024, our Board comprised a total of eight (8) Directors, all of whom were non-executive Directors except for our President & CEO who was the only ED. IDs represented half of our Board.

On 24 April 2024, as part of the Board renewal process, the following changes were made to the composition of our Board (collectively “Change in Board Composition”):

- Adrian Chan and Jenny Young were appointed as IDs;

- Ho Koon Lian Irene stepped down as a Non-ID after having served on our Board since May 2015;

- upon the conclusion of the FY2023 AGM held on 24 April 2024, Ronald Seah was re-designated from an ID to Non-ID but remained as Chairman of our Board; and

- Stephen Yeo was appointed as Non-Executive and Lead Independent Director (“Lead ID”)

After the Change in Board Composition, our Board currently comprises nine (9) Directors, all of whom are non-executive Directors except for our President & CEO who is the only ED. IDs represent a majority of our Board. As our Chairman is a Non-ID, a Lead ID has been appointed.

Board independence

As noted above, there were changes in the composition of our Board in the course of FY2024. Throughout these changes, our Board at all times comprised a majority of non-executive Directors, with IDs representing at least half or a majority of our Board. Our Board believes that there was at all times a strong and independent element on our Board.

Our Board is led by our Chairman, Ronald Seah, who is a Non-ID. Following the conclusion of the FY2023 AGM held on 24 April 2024, Ronald Seah was re-designated from an ID to a Non-ID pursuant to the transitional arrangements applicable to an independent director who has served as an independent director for an aggregate period of more than 9 years. Notwithstanding, our Board deliberated and decided that Ronald Seah shall continue to lead our Board as Chairman. In making this decision, our Board took into account, among other things: (a) his strong leadership; (b) his experience, knowledge and familiarity with our Group’s business and operations, which provide the necessary continuity in view of the renewal of our Board during the past few years and as our Group continues in its journey of business transformation in a challenging and evolving business environment; and (c) that he has continued to demonstrate objectivity and independent judgment.

Concurrently with the above, and in order to maintain a strong and independent element on our Board, Stephen Yeo was appointed as Lead ID, and two (2) new IDs were appointed to our Board. Following these changes, our Board currently comprises five (5) IDs, being Stephen Yeo, Adrian Chan, Cheah Sui Ling, Jenny Young and Shailesh Ganu, which represent a majority of our Board.

The Non-IDs are Ronald Seah, Stephen Miller and Lim Yong. They are considered non-independent as:

- Ronald Seah has served on our Board for more than nine (9) years, and was no longer eligible to be considered as independent under the Listing Manual;

- Stephen Miller is a director, and the President and Group Chief Executive Officer, of Singapore Technologies Telemedia Pte Ltd, a controlling shareholder of Company; and

- Lim Yong is a director of Leap International Pte Ltd (“Leap”), a controlling shareholder of our Company, and also the son of Lim Chai Hock Clive, who owns 100% of Leap and is also a controlling shareholder of our Company.

Our Board continues to be able to exercise objective and independent judgement, given that almost all of our Board are non-executive Directors and a majority of our Board comprises IDs.

Assessment of independence

Our Board, taking into account the views of our NRC, assesses the independence of each Director annually in accordance with the guidance in the Code and the Practice Guidance to the Code (“Practice Guidance”).

Criteria for assessment

Our NRC and our Board assess the independence of a Director by reference to the factors set out in Rule 210(5)(d) of the Listing Manual, as well as Provision 2.1 of the Code and the applicable guidance in the Practice Guidance, in relation to the criteria for independence. In particular, under the Code, a Director is considered independent if he or she is independent in conduct, character and judgement, and has no relationship with our Company, our related corporations, our substantial shareholders or our officers that could interfere, or be reasonably perceived to interfere, with the exercise of his or her independent business judgement in the best interests of our Company.

Process for assessment

Our Board and our NRC adopt a rigorous process to evaluate the independence of an ID. As part of the process, our Board and NRC take into account, among other things, the following:

- the directorships held by and other commitments of an ID, and whether any such directorship or commitment gives rise to any conflict or potential conflict of interests;

- the disclosure by an ID of interest in a transaction or proposed transaction with our Group that is required under our Constitution and/or the provisions of the Companies Act;

- the declaration in relation to independence, by reference to the criteria of independence in the Listing Manual as well as the Code, which each ID is required to make annually;

- whether the ID has demonstrated objectivity and independent judgment in discharging his or her duties and responsibilities; and

- whether the ID has recused from deliberation, and abstained from voting, on any matter that gives rise to conflict or apparent conflict of interests.

Our NRC will make an assessment of independence and then make its recommendation to our Board on whether an ID should be considered as independent.

FY2024 assessment

Based on the assessment conducted in respect of FY2024, our Board, taking into account the views of our NRC, has assessed Stephen Yeo, Adrian Chan, Cheah Sui Ling, Jenny Young and Shailesh Ganu to be independent (with each ID having refrained from deliberation on the assessment of his or her own independence).

In arriving at such determination, our Board had noted that: (a) none of the five (5) IDs is currently employed or has been employed at any time during the past three (3) financial years by our Company or any of our related corporations; (b) all five (5) IDs do not have immediate family members who are currently employed or have been employed at any time during the past three (3) financial years by our Company or any of our related corporations, and whose remuneration is determined by the RC; (c) all five (5) IDs have provided confirmation that they are not related to our Directors or substantial shareholders of our Company; (d) there was no other relationship which could affect their independence; and (e) they had demonstrated objectivity and independent judgment during Board meetings and deliberations.

In relation to Adrian Chan, it was noted that he is Head of Corporate Department and a Senior Partner of Lee & Lee, a law firm which provides corporate secretarial and legal services to our Group. In its assessment of the independence of Adrian Chan, our Board has taken into account that: (i) he does not personally act, and has never personally acted, in relation to any legal work by Lee & Lee for our Group; (ii) he is not involved in the selection and appointment of the service provider for such services for our Group; (iii) the amount of fees received by Lee & Lee from the services provided to our Group for FY2024 did not exceed S$200,000; (iv) he has a deep understanding of the role of an independent director, taking into account his legal experience, his many years of involvement at the Singapore Institute of Directors (of which he is currently First Vice-Chair) and his many years of experience as a listed company director; and (v) he has demonstrated objectivity and independent judgment during his participation in meetings of our Board and Board Committees of which he is a member.

Based on the above, our Board, having taken into account the views of our NRC, is of the view that the provision of services by Lee & Lee to our Group should not interfere with Adrian Chan’s ability to exercise independent business judgment in the best interests of our Company, and he should be treated as an ID.

Board diversity

Benefits of diversity

We recognise the benefits of diversity in terms of skills, knowledge and experience, as well as broader aspects of diversity such as gender and age, and believe that an appropriate balance of diversity will raise the level of Board discussions, enhance the decision-making process and better support our Company in achieving our strategic objectives.

Board Diversity Policy

Our Board has adopted a formal Board Diversity Policy for promoting diversity on our Board. The Board Diversity Policy provides, among other things, that:

- Our Company recognises that a Board comprising appropriately qualified members with a broad range of relevant skills, knowledge and experience, and other aspects of diversity such as gender and age, will bring diversity of thought and different perspectives to Board discussions, avoid group-think and enhance the decision-making process of our Board. Our Company believes that a diverse Board is essential to the effective governance of our business and ensuring long-term sustainable growth. Accordingly, our Company is committed to promoting diversity on our Board.

- Our Board will consider all aspects of diversity, including educational background, skills, industry and business experiences, gender, age, ethnicity and culture, geographical background and nationalities, tenure of service, and other distinguishing qualities of the members of our Board.

- In particular, our Board has identified the diversity in terms of skills, experience, independence, gender, age and tenure

as important aspects of diversity that are elaborated on in the Board Diversity Policy. In relation specifically to gender

diversity, our Board believes that there should be female representation on our Board and will strive to:

- ensure that female candidates are included for consideration by our NRC whenever it seeks to identify a new Director for appointment to our Board;

- ensure that if external search consultants are engaged to identify candidates for appointment to our Board, the consultants will be asked to present female candidates for consideration; and

- align with the target set by the Council for Board Diversity for female board representation to the extent reasonably practicable.

- The consideration and selection of candidates for appointment to our Board will ultimately be based on merit, with the objective of achieving the appropriate mix and balance of skills, experience and diversity of perspectives on our Board that will meet the requirements of our Company from time to time.

- In the implementation of the Board Diversity Policy, our NRC will consider and, if appropriate, set qualitative and quantitative objectives for promoting and achieving diversity on our Board, taking into account our Directors’ mix of background, skills, experiences and qualities that our Board requires to function competently and efficiently in the context of the scope and nature of our Company’s business and operations and the corporate strategy.

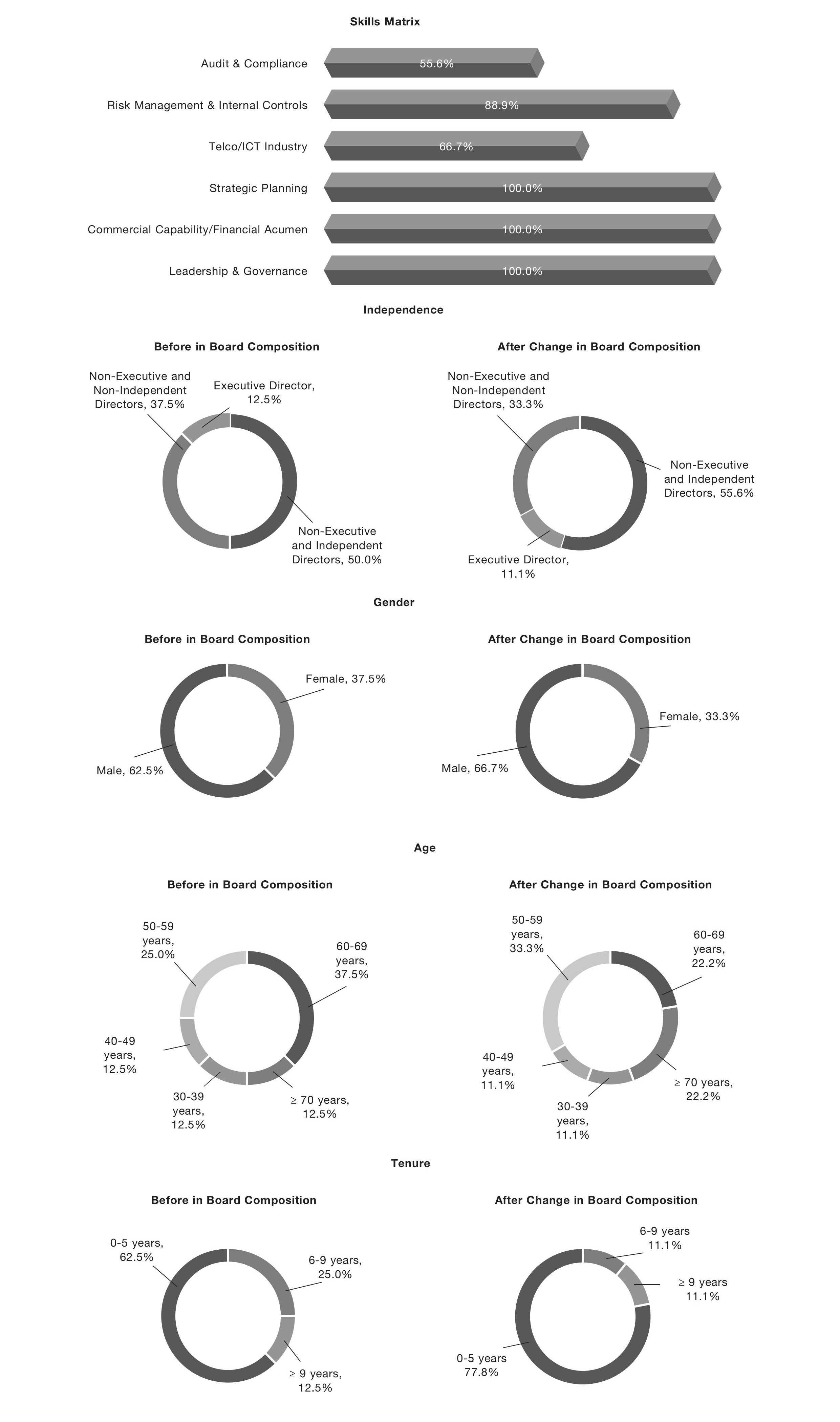

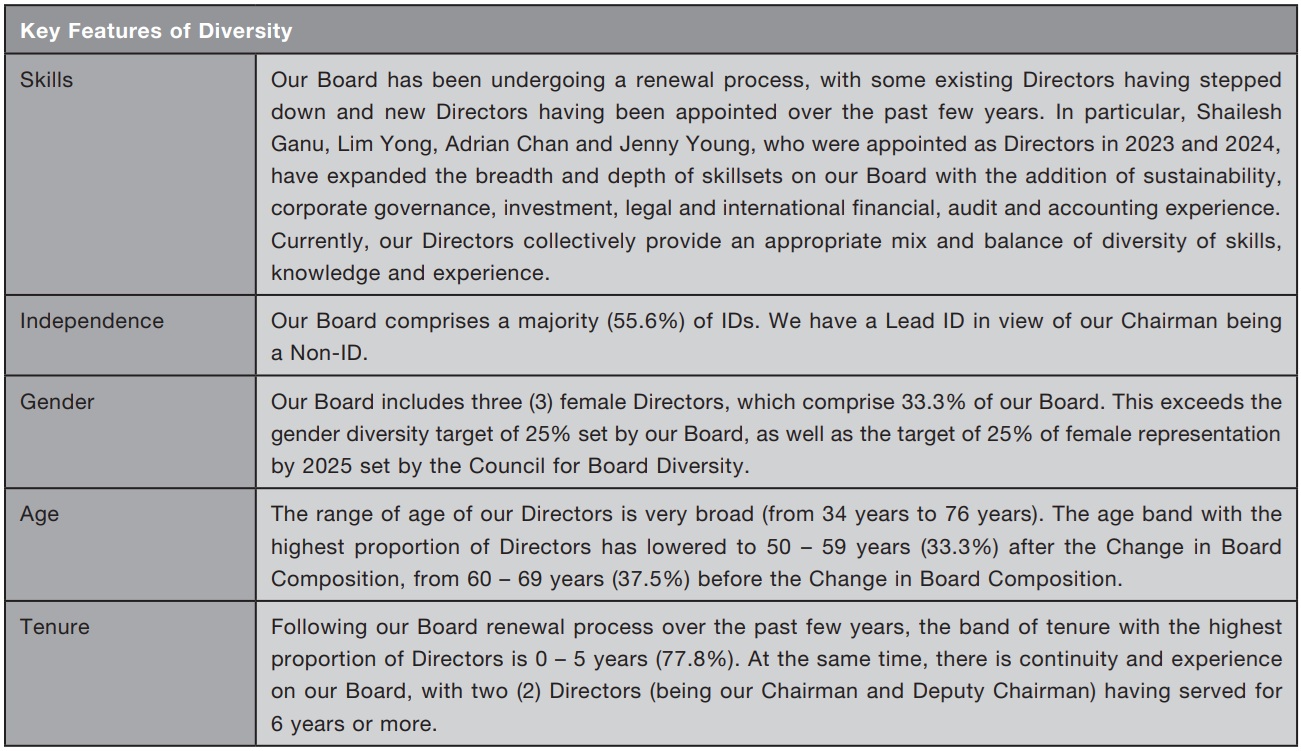

Diversity profile

As noted above, our Company implemented the Change in Board Composition in April 2024 as described in the section “Board composition” under Principle 2: Board Composition and Guidance.

Our NRC uses a skills matrix to determine the skills gaps of our Board and to assess if the expertise and experience of a candidate would complement those of our existing Board members. The skills matrix classifies skills, experience and knowledge of our existing Directors into the broad categories of leadership and governance, commercial capability/financial acumen, strategic planning, telco/ICT industry, risk management and internal controls, and audit and compliance. With the Change in Board Composition, the range of skills and experience of our Directors has been further augmented. Adrian Chan brings with him many years of legal experience as a corporate lawyer and as a listed company director, while Jenny Young brings with her many years of international experience in finance, audit and accounting. Following the Change in Board Composition, our Board has nine (9) Directors who collectively have a broad range of core competencies and skills, knowledge and experience.

The diversity profile of our Board in terms of the skills matrix, independence, gender, age and tenure before and after the Change in Board Composition is reflected the following charts:

Our Board is of the view that the current Board members, collectively as a group, provide an appropriate mix and balance of diversity of skills, knowledge, experience, independence, gender, age and tenure.

The current composition of our Board enables Management to benefit from external diverse and objective perspectives of issues from our Board, avoid groupthink and foster constructive debate. It also enables our Board to interact and work with Management through a robust exchange of ideas and views to help shape strategic directions. This, coupled with a clear separation of the role of our Chairman and our President & CEO, provides a healthy professional relationship between our Board and Management, with clarity of roles and robust oversight.

In addition, our Non-IDs and IDs also meet separately, whether formally or informally, without the presence of our ED or Management on a regular basis and also as and when the need arises, and the chairman of such meetings will provide feedback to our Board and/or Chairman as appropriate.

Diversity targets

Our Board has deliberated and continues to target to maintain female representation on our Board at a minimum of 25%. This is consistent with the target of 25% for female representation by 2025 set by the Council for Board Diversity. Our Board currently already meets this target, with 33.3% of female representation on our Board.

As our Board is of the view that there has already been an ongoing Board renewal process for the past few years and the current Board members, collectively as a group, provide an appropriate mix and balance of diversity of skills, experience, independence, gender, age and tenure, our Board has not set any further diversity targets. Our Board will also continue to consider diversity in relation to any future changes to the composition of our Board, taking into account the Board Diversity Policy.

Principle 3: Chairman & Chief Executive Officer

There is a clear division of responsibilities between the leadership of the Board and Management, and no one individual has unfettered powers of decision-making.

Roles of Chairman and President & CEO

We believe there should be a clear separation of the roles and responsibilities between our Chairman and the President & CEO. The Chairman is elected by our Board and is a non-executive position currently held by Ronald Seah, our Non-ID. The President & CEO is Pauline Wong, who is also our ED. They are separate persons and are not related to each other, but maintain a relationship of trust and work collaboratively to lead our Group in their respective capacities, in order to maintain an effective balance of power, increased accountability and greater capacity of our Board for independent decision making.

Our Chairman, Ronald Seah, leads and oversees the performance of our Board and ensures that our Board members work together with Management, with the capability and moral authority to engage and contribute effectively and constructively on various matters, including strategic issues and business planning processes. He also spends considerable time to keep himself updated on our Group’s business and operations, and plays an active leadership role, together with our EC, by providing clear oversight, direction and guidance to our President & CEO.

Our President & CEO, Pauline Wong, is charged with full executive responsibility for the running of our businesses, making operational decisions and implementing business directions, strategies and policies. Our President & CEO is supported on major business and operational issues by the oversight of our EC.

Lead ID

Our Chairman, Ronald Seah, was re-designated from an ID to a Non-ID upon conclusion of the FY2023 AGM as he had served on our Board for more than nine (9) years. After careful deliberation, our Board decided that Ronald Seah should remain in his role as Chairman for the reasons disclosed in the section “Board independence” under Principle 2: Board Composition and Guidance.

Concurrently with our Chairman becoming a Non-ID, Stephen Yeo was appointed as Lead ID. In appointing Stephen Yeo as Lead ID, our Board took into account, among other things, that: (a) he had held senior leadership positions and has deep experience in the industry; (b) he has been on our Board for around three (3) years (which was one of the longest tenure among the IDs at that time) and would have a sufficient level of familiarity with our Group to be able to perform that role; and (c) he has demonstrated objectivity and independent judgment in discharging his duties. As Lead ID, he will provide leadership in situations where the Chairman is conflicted, and he is available to shareholders should they have concerns which cannot be resolved or are inappropriate to raise through the normal communication channels of the Board Chairman or Management. No query or request on any matter which requires the Lead ID’s attention was received from shareholders in FY2024 since his appointment.

Our Board believes that, with the appointment of Stephen Yeo as Lead ID and our Board comprising a majority of IDs, the continued appointment of Ronald Seah as Chairman does not affect the balance of power within our Board, and there remains a strong and independent element on our Board and no individual Director or Directors has unfettered powers of decision-making.

Principle 4: Board Membership

The Board has a formal and transparent process for the appointment and re-appointment of directors, taking into account the need for progressive renewal of the Board.

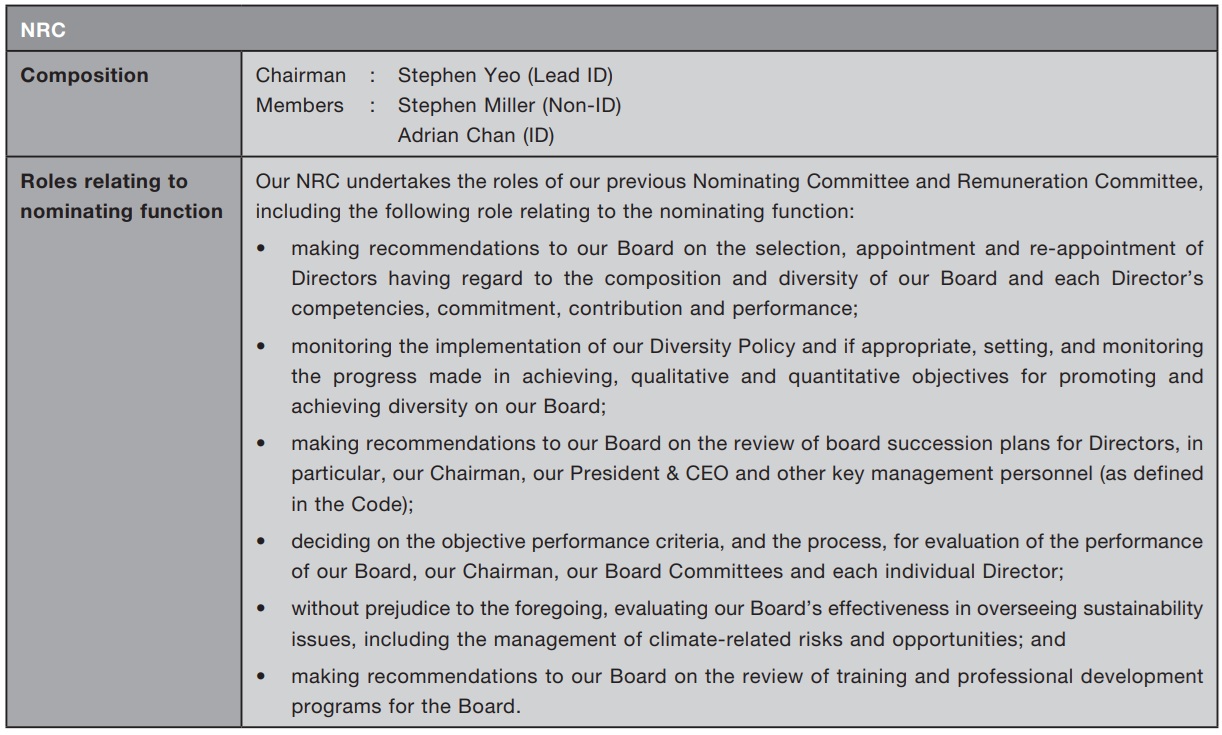

NRC composition and role in relation to nominating functions

Our Board has a formal and transparent process for the appointment and re-appointment of Directors. Previously, our Nominating Committee made recommendations to our Board on all Board and Board Committee appointments. With effect from 24 April 2024, our Nominating Committee was combined with our Remuneration Committee to form our NRC, with a view to streamlining the structure of our Board Committees and to achieve greater efficiency.

Our NRC comprises three (3) members, all of whom are non-executive Directors. A majority of our NRC are IDs, including the Chairman who is our Lead ID. Our NRC performs the functions previously fulfilled by our Nominating Committee and Remuneration Committee. The nominating-related functions of our NRC, as set out in the written NRC charter, are summarised below, while the remuneration functions of our NRC are summarised in the section “NRC composition and role in relation to remuneration functions” under Principle 6: Procedures for Developing Remuneration Policies.

Our NRC is guided by the terms of its charter which are aligned with requirements under the Code. All decisions at any NRC meeting are decided by a majority of votes of NRC members present and voting (the decision of our NRC shall at all times exclude the vote, approval or recommendation of any member having a conflict of interest in the subject matter under consideration).

During FY2024, the key activities performed by our Nominating Committee/NRC included, among other things: (a) assessment of the independence of our IDs; (b) assessment of the commitment of our Directors; (c) assessment and recommendation to our Board on the re-election of Directors who were retiring at the FY2023 AGM held on 24 April 2024; (d) implementing the annual evaluation of the performance of our Board, Board Committees, Chairman and each Director; and (e) assessment and recommendation to our Board on the Board renewal process and, in particular, the suitability of Adrian Chan and Jenny Young, who were appointed as IDs on 24 April 2024.

Selection, appointment and re-appointment of Directors

Our Company has in place a formal process for selecting and appointing new Directors as well as for the re-appointment of retiring Directors.

Criteria and process

Our NRC will review, assess and make its recommendation to our Board on the appointment of new Directors and the re-election of existing Directors pursuant to their retirement by rotation or retirement following appointment to fill a casual vacancy. In making its recommendation, our NRC will consider, among other things:

- The track record, skills, knowledge, experience and capability of the candidate or existing Director.

- The core competencies and mix of skills, knowledge and experience of our existing Directors, so as to identify any specific attributes that are required and/or desired at Board level and consider whether and how the skills, knowledge and experience of the candidate or existing Director being considered for re-election will complement, add to and/or enhance the skillsets and core competencies of our Board.

- The considerations based on our Board Diversity Policy and the extent to which diversity targets will be met.

- The principal commitments (including listed directorships) of the candidate or existing Director, so as to assess his or her ability to adequately carry out his or her duties and responsibilities as a Director.

- The independence of the candidate or existing Director (in the case of appointment as ID).

- In relation to existing Directors being considered for re-election, his or her commitment, contribution and performance (including attendance, preparedness, participation and candour) at meetings of our Board and Board Committees.

In relation to the appointment of a new Director, potential candidates may be proposed by existing Directors, Management or through third-party referrals. External consultants are engaged to assist with the selection process, if necessary. As part of the process, short-listed candidates will be required to furnish their curriculum vitae stating in detail (among other things) their educational and professional qualifications, working experience, employment history, current and past directorships and current principal commitments and, in the case of a candidate being considered for appointment as an ID, factors that will affect independence. Our NRC takes an active role in screening short-listed candidates, including interviewing the candidates. Our NRC will carefully evaluate each potential candidate and such evaluation will, where appropriate, extend to whether he or she has fully discharged his or her duties and obligations during his or her previous directorship of any listed company, has previously served on the board of any company with an adverse track record or a history of irregularities, has been under investigation by any professional association or regulatory authority, or has resigned from the board of any such company for any reason that may cast doubt on his or her ability to act as a Director.

Board renewal

Our NRC is responsible for reviewing Board succession planning from time to time and as when a Director gives notice of his or her intention to retire or resign. The review takes into account, among other things, the requirements in the Listing Manual and the Code, feedback from our Directors, the Board Diversity Policy as well as any diversity targets that may have been set. Board renewal is undertaken in an orderly and progressive manner, so as to ensure continuity, stability and sustainability of corporate performance.

Our Board has undergone a progressive Board renewal process during the past few years, with several long-serving Directors having retired and several new Directors having been appointed. As part of the Board renewal process, our Non-ID, Ho Koon Lian Irene, stepped down from our Board after the conclusion of our FY2023 AGM held on 24 April 2024, after having served on our Board since May 2015. With the re-designation of Ronald Seah from ID to Non-ID upon conclusion of the FY2023 AGM, our Board was looking to appoint two (2) additional IDs with a view to maintaining a strong and independent element on our Board.

Our Board considered a number of candidates and eventually Adrian Chan and Jenny Young were identified through internal referrals without the involvement of any external consultant. Our Nominating Committee at that time had assessed Adrian Chan and Jenny Young and recommended their appointment to our Board based on their track record and experience and by reference to the assessment criteria mentioned above. The appointment of Adrian Chan and Jenny Young as IDs was approved by our Board, taking into account the recommendation of our Nominating Committee, and they were appointed with effect from 24 April 2024.

Retirement and re-election

Our Constitution requires one-third of our Directors to retire and subject themselves to re-election by shareholders at every AGM (“one-third rotation rule”). In other words, no Director stays in office for more than three (3) years without being re-elected by our shareholders.

In addition, a newly-appointed Director is required to submit himself or herself for retirement and re-election at the AGM immediately following his/her appointment. Thereafter, he or she is subject to the one-third rotation rule.

Pursuant to the one-third rotation rule, Pauline Wong, Stephen Yeo and Cheah Sui Ling will retire by rotation at the FY2024 AGM to be held on 28 April 2025. They have put themselves up for re-election, and will therefore be subject to re-election by shareholders at the AGM.

Pursuant to Regulation 105 of our Constitution, Adrian Chan and Jenny Young will retire at the FY2024 AGM to be held on 28 April 2025 as they were appointed by our Board in the course of FY2024. They have put themselves up for re-election, and will therefore be subject to re-election by shareholders at the AGM.

Our NRC has considered and recommended the re-election of these Directors by reference to the assessment criteria set out above. Our Board has considered our NRC’s recommendation and assessment of each of these Director’s skills, knowledge and experience, as well as the overall size, composition and diversity of skillsets of our Board, and is satisfied that each of these Directors will continue to contribute to our Board and to the combination of skills, knowledge, experience and diversity required on our Board. Please see the section “Additional Information in relation to Directors Standing for Re-election” for further information.

Assessment of independence

Our NRC assesses the independence of each Director annually in accordance with the criteria set out in the Listing Manual as well as the Code and the Practice Guidance. The criteria and process for such assessment, as well as the assessment on the independence of our Directors in respect of FY2024, are described in detail in the section “Assessment of independence” under Principle 2: Board Composition and Guidance above.

If, in respect of any Director, there exists any relationships which would affect his or her independent status under the relevant provisions of the Listing Manual, the Code and/or the Practice Guidance, but our Board (having taken into account the view of our NRC) determines such Director to be independent, such relationships will be disclosed in our Annual Report together with an explanation of our Board’s determination. No such issue has occurred in respect of FY2024.

Assessment of Directors’ Commitment

In view of the responsibilities of a Director, Directors need to be able to devote sufficient time and attention to adequately perform their duties and responsibilities. Our NRC reviews the other appointments and commitments of each Director as part of the assessment criteria at the time of appointment, and also on an annual basis and as and when there is a change of circumstances involving a Director which may affect his or her ability to commit time to the Company. This is to assess whether a Director is able to and has been adequately carrying out his or her duties and responsibilities as a Director and, in particular, whether a Director who serves on multiple boards is able to commit the necessary time and attention to serve on our Board. In this regard, our NRC has established an internal guideline that: (a) a Director holding a full time position should not be a director of more than four (4) listed companies; and (b) a “professional” Director should not be a director of more than six (6) listed companies. However, our NRC recognises that the individual circumstances and capacity of each Director are different and there may be circumstances in which a different limit on board appointments is appropriate. As such, our NRC has the discretion to deviate from this guideline on a case-by-case assessment.

The directorships of our Directors in other listed companies and their principal commitments are set out in their respective profiles on pages 6 to 10 of this Annual Report. The attendance record of our Directors is set out in the section “Board and Board Committee meetings” under Principle 1: Board’s Conduct of its Affairs.

In terms of directorships in other listed companies, all of our Directors currently fall within the internal guideline, except for Adrian Chan. Adrian Chan currently holds directorships in a total of five (5) listed companies, including our Company, and also directorships and other appointments in other companies and organisations. Notwithstanding, the Nominating Committee at that time had assessed that Mr Adrian Chan has the capacity to act as a Director taking into account: (a) his experience as a corporate lawyer and familiarity with the laws and regulations governing listed companies; (b) his deep experience as a director of many listed companies over many years, including as chairman of the board as well as chairman or member of different board committees; (c) that he has a 100% attendance record for all meetings of our Board and Board Committee of which he is a member held in FY2024 after his appointment; (d) he has participated actively in and contributed to discussions during Board and Board Committee meetings; and (e) that he has confirmed that he will be able to devote sufficient time to attend Board and relevant Board Committee meetings and to carry out his duties and responsibilities as a Director.

Based on the foregoing, our NRC (with each member having abstained from the deliberations in respect of himself) has determined that each Director has been adequately carrying out his or her duties as a Director. The Board, taking into consideration our NRC’s assessment, concurs that each Director has adequately carried out his or her duties and responsibilities as a Director for FY2024.

Principle 5: Board Performance

The Board undertakes a formal annual assessment of its effectiveness as a whole, and that of each of its board committees and individual directors.

Our Board believes it is important to have a formal assessment of our Board’s performance to ensure our Board is and continues to be effective in discharging its role. Our NRC has implemented an objective performance criteria and the process to be used for evaluating the effectiveness of our Board as a whole and our Board Committees separately, as well as our Chairman and each Director. The performance evaluation criteria are reviewed periodically, but are not changed from year to year unless our NRC is of the view that it is necessary to do so.

Appraisal criteria

The evaluation of our Board as a whole is based on criteria that include clarity of structure and function, flow and adequacy of information provided, effectiveness and focus of Board meetings, goals and targets set for Management and understanding and support of our Group’s strategic focus. The evaluation of our Board Committees is based on criteria that include structure and functions of our Board Committees, the support provided to our Board, sufficiency of independent members and the expertise and resources available. The evaluation of our Chairman is based on criteria that include the leadership, conduct of meetings, promoting openness and discussions, facilitating contributions by Directors, corporate governance and effective communication with shareholders.

In terms of the evaluation of each Director, our Board has adopted a self-appraisal system where each Director will evaluate himself or herself. The evaluation is based on criteria that include understanding of roles and responsibilities, understanding and support of Group strategic focus, working with Management to achieve Group strategy and objectives, contribution to Board meetings and ability to help address performance and corporate governance deficiencies.

Appraisal process

On an annual basis, each Director is requested to complete an appraisal form setting out the different evaluation criteria in respect of our Board, our Board Committees, our Chairman and each Director. The completed forms are collated by our Company Secretary, and the results of the evaluation exercise are summarised and presented to our NRC. Our NRC will deliberate on the evaluation results and, where appropriate, recommend to our Board any changes that may be required to our Board and/or Board Committees and/or any other follow-up actions that may be appropriate to address any issues identified. The appraisal process is overseen by our NRC but our NRC may, where it considers appropriate and with the concurrence of our Board, engage an external party periodically to conduct the evaluation exercise.

Our Board has completed its appraisal exercise for FY2024 based on the appraisal criteria and process described above. Our NRC is satisfied that for FY2024, our Board and Board Committees, our Chairman and each Director were effective in the discharge of their respective duties and responsibilities. The results of our NRC’s assessment were communicated to and accepted by our Board. No external facilitator was used in FY2024.

(B) Remuneration Matters

Principle 6: Procedures for Developing Remuneration Policies

The Board has a formal and transparent procedure for developing policies on director and executive remuneration, and for fixing the remuneration packages of individual directors and key management personnel. No director is involved in deciding his or her own remuneration.

Principle 7: Level and Mix of Remuneration

The level and structure of remuneration of the Board and key management personnel are appropriate and proportionate to the sustained performance and value creation of the company, taking into account the strategic objectives of the company.

Principle 8: Disclosure on Remuneration

The company is transparent on its remuneration policies, level and mix of remuneration, the procedure for setting remuneration, and the relationships between remuneration, performance and value creation.

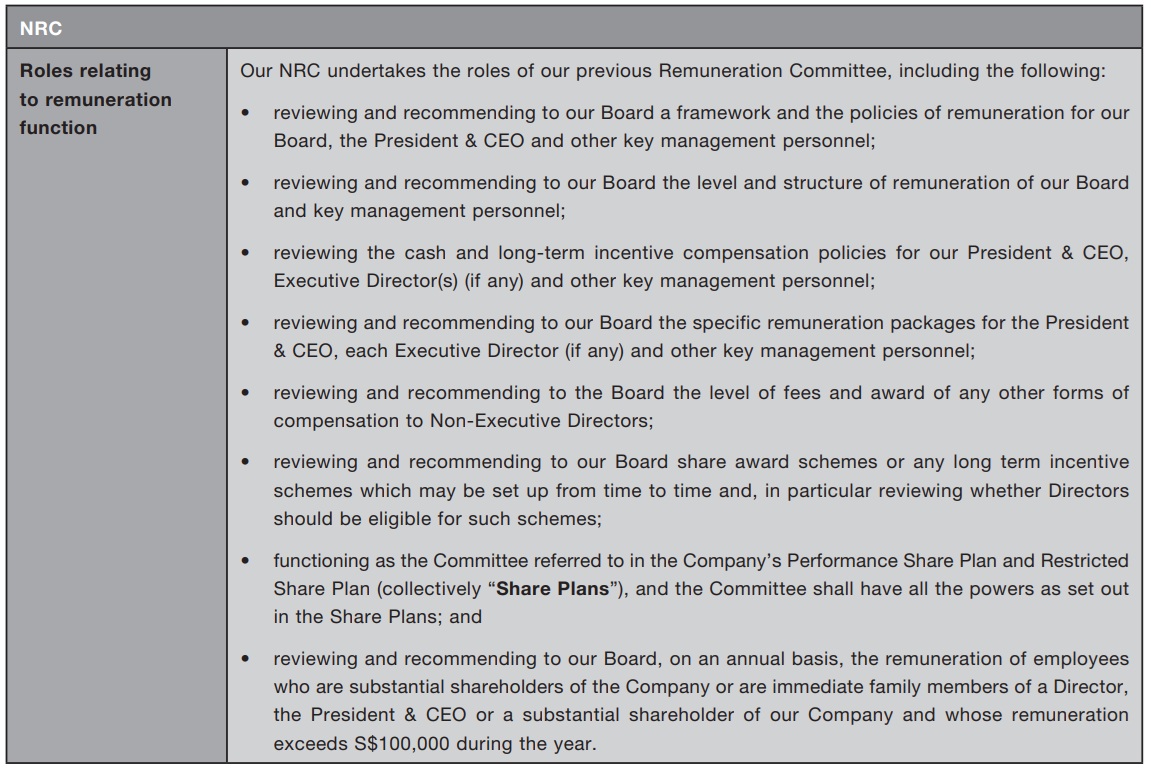

NRC composition and role in relation to remuneration functions

The Board has a formal and transparent procedure for developing policies on Director and executive remuneration, recommending individual Directors’ remuneration packages for shareholders’ approval and determining the remuneration of key management personnel.

Previously, the Remuneration Committee was responsible for making recommendations to our Board on remuneration-related matters. With effect from 24 April 2024, our Remuneration Committee was combined with our Nominating Committee to form our NRC, with a view to streamlining the structure of our Board Committees and to achieve greater efficiency.

The current composition of our NRC is set out in the section “NRC composition and role in relation to nominating functions” under Principle 4: Board Membership. Our NRC comprises three (3) members, all of whom are non-executive Directors. A majority of our NRC are IDs, including the Chairman who is our Lead ID. Our NRC performs the functions previously fulfilled by our Remuneration Committee. The remuneration-related functions of our NRC, as set out in the written NRC charter, are summarised below.

Our NRC is guided by the terms of its charter which are aligned with requirements under the Code. All decisions at any NRC meeting are decided by a majority of votes of NRC members present and voting (the decision of our NRC shall at all times exclude the vote, approval or recommendation of any member having a conflict of interest in the subject matter under consideration).

During FY2024, the key activities performed by our Remuneration Committee/NRC included, among other things: (a) deliberating on the remuneration framework for our Directors, ED and President & CEO and other key management personnel; (b) reviewing and making a recommendation on the fees of our Directors; (c) assessment of the performance and the specific remuneration package of our ED and President & CEO and other key management personnel; (d) reviewing the vesting results under the Share Plans; and (e) setting of targets for the grant of awards and allocation of awards under the Share Plans.

Process for assessment of remuneration framework

On an annual basis, our NRC undertakes an assessment of the remuneration framework and structure for our Board, our ED and President & CEO and other key management personnel, as well as specific remuneration packages for our ED and President & CEO and other key management personnel. Our NRC will also review cash and long-term incentive compensation policies for our President & CEO and key management personnel. Our NRC will make its recommendations to our Board based on such assessment and review for approval by our Board.

Our NRC has access to expert professional advice on human resource matters whenever there is a need to consult externally. Aon Solutions Singapore Pte. Ltd. (“Aon”) was appointed to provide professional advice on certain human resource matters. Aon only provides human resource consulting services to our Company and has no other relationships with our Company. In its deliberations, our NRC takes into consideration industry practices and norms in compensation. Our ED and President & CEO is not present during the discussions relating to her own compensation, and terms and conditions of service, and the review of her performance. However, our ED and President & CEO will be in attendance when our NRC discusses the policies and compensations of our key management personnel, as well as major compensation and incentive policies such as share options, stock purchase schemes, framework for bonus, staff salary and other incentive schemes.

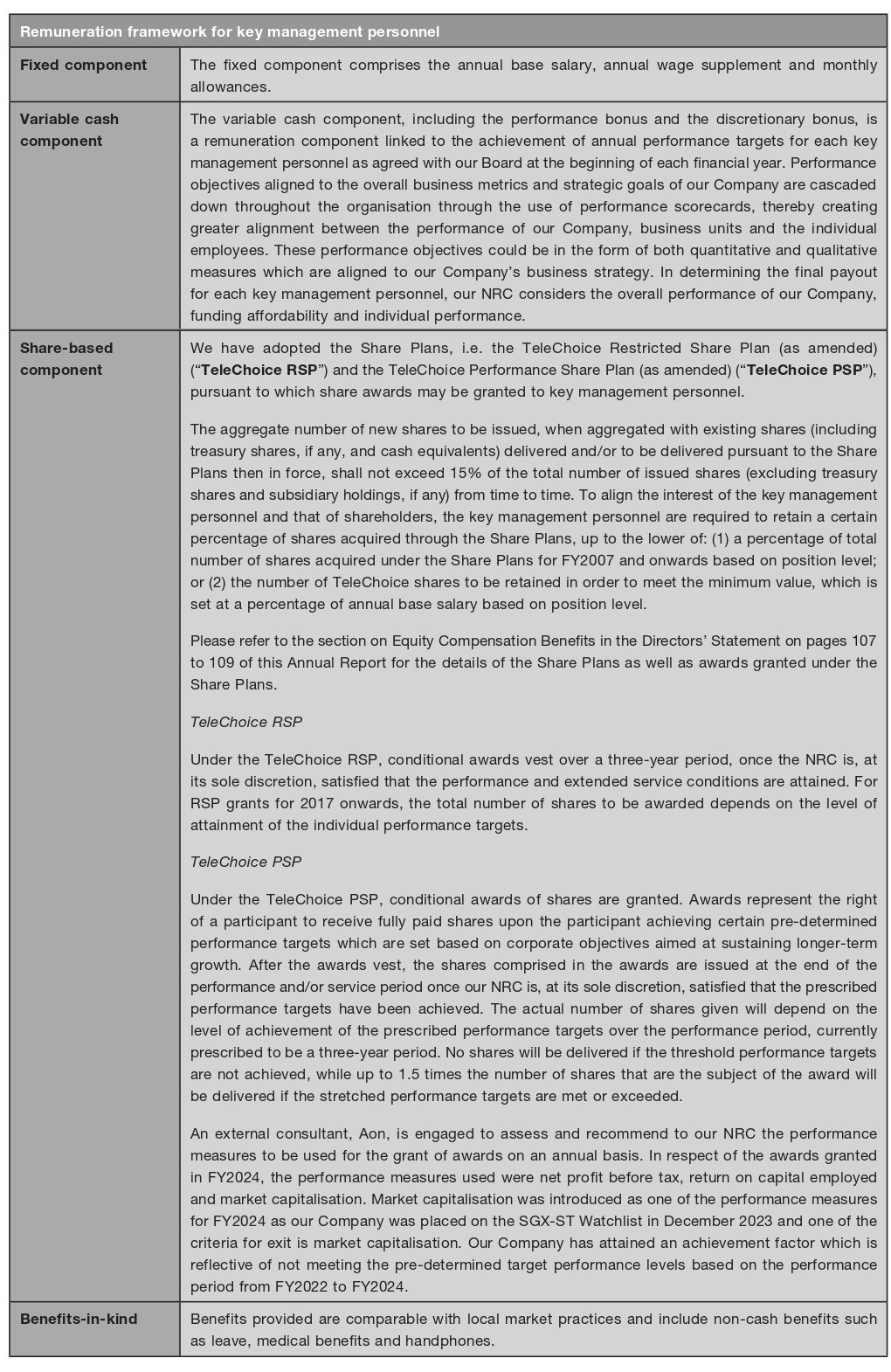

Remuneration policy and framework for Management

We adopt a performance-based remuneration framework for our ED and President & CEO and other key management personnel, which is designed to link a significant and appropriate proportion of remuneration to our Company performance as well as individual performance. The framework seeks to achieve a balance between current considerations and long-term objectives and sustainability of our Group, and align their compensation with the interests of shareholders and other stakeholders. In particular, a significant proportion of the remuneration of key management personnel is by way of variable compensation, which comprises short-term incentives in the form of annual cash bonus that is tied to yearly performance targets as well as longer-term incentives in the form of share-based component that is tied to different performance targets over a period of time.

Based on the foregoing policies, the remuneration framework for our ED and President & CEO and other key management personnel comprises a fixed component, a variable cash component, a share-based component and benefits-in-kind, as elaborated below:

In performing the duties as required under its terms of reference, our NRC ensures that remuneration paid to the key management personnel is strongly linked to the achievement of business and individual performance targets, industry practices and compensation norms and the need to ensure the continuing development of talents. The performance targets as determined by our NRC are set at realistic yet stretched levels each year to motivate a high degree of business performance with emphasis on both short-term and long-term quantifiable objectives. Our NRC also considers the tight talent market for key management personnel in setting total compensation levels. Our NRC is satisfied that the level and mix of remuneration is appropriate and is aligned with pay-for-performance principles.

Under the Practice Guidance, the compensation system should take into account the risk policies of our Company, be symmetric with risk outcomes and be sensitive to the time horizon of risks. Our NRC has reviewed the various compensation risks that may arise and introduced mitigating policies to better manage risk exposures identified. Our NRC also undertakes periodic reviews of the compensation related risks.

From FY2014, our Company has implemented a contractual “clawback” provision in the event that an ED or other key management personnel of our Company engages in fraud or misconduct, which results in restatement of our Company’s financial results or a fraud/misconduct resulting in financial loss to our Company. Our Board may pursue to reclaim the unvested components of remuneration from an ED or key management personnel from all incentive plans for the relevant period, to the extent such incentive has been earned but not yet released or disbursed. Our Board, taking into account our NRC’s recommendation, can decide whether and to what extent, such recoupment of the incentive is appropriate, based on the specific facts and circumstances of the case.

Remuneration of Management

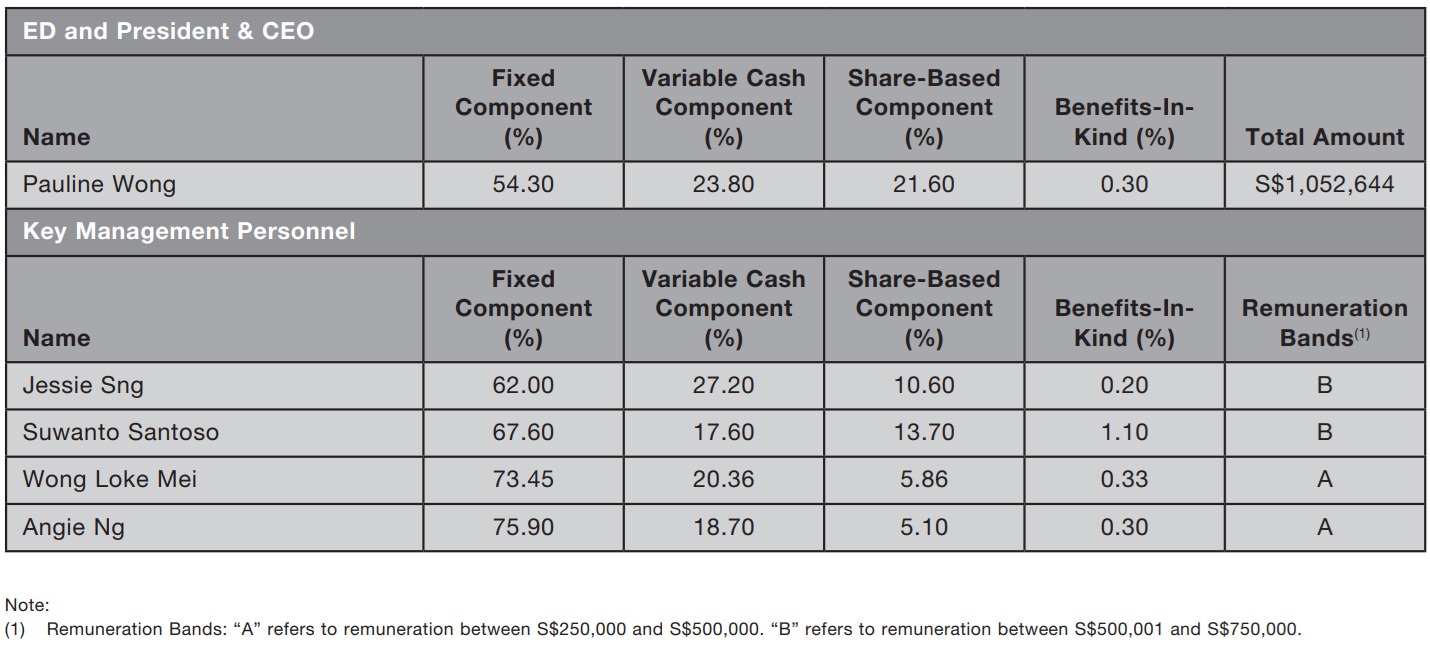

Details of remuneration paid to our ED and President & CEO and top five (5) key management personnel for FY2024 are set out in Table 2 below.

Table 2: FY2024 – Remuneration of ED and President & CEO and Top Five (5) Key Management Personnel

For FY2024, we have disclosed the exact amount and breakdown of the remuneration of our ED and President & CEO above.

The aggregate remuneration paid to the top five (5) key management personnel including the President & CEO amounted to approximately S$2,994,414. For competitive reasons, we have disclosed the remuneration of the top five (5) key management personnel (who are not Directors or CEO) in bands of S$250,000. Our Board notes that this Report has already disclosed the policy and framework for remuneration of Management, including details on the different components of the remuneration. Our Board is of the view that the disclosure of such information, together with disclosure of the remuneration of the top five (5) key management personnel in bands of S$250,000 with a breakdown of the level and mix of the remuneration in the above table, provide shareholders with sufficient insight into the compensation of our top five (5) key management personnel and is consistent with the intent of Principle 8.

For FY2024, there were no termination, retirement and post-employment benefits granted to key management personnel.

There is no employee who is a substantial shareholder of our Company, or an immediate family member of a Director or the ED and President & CEO or a substantial shareholder of our Company, whose remuneration exceeds S$100,000 a year.

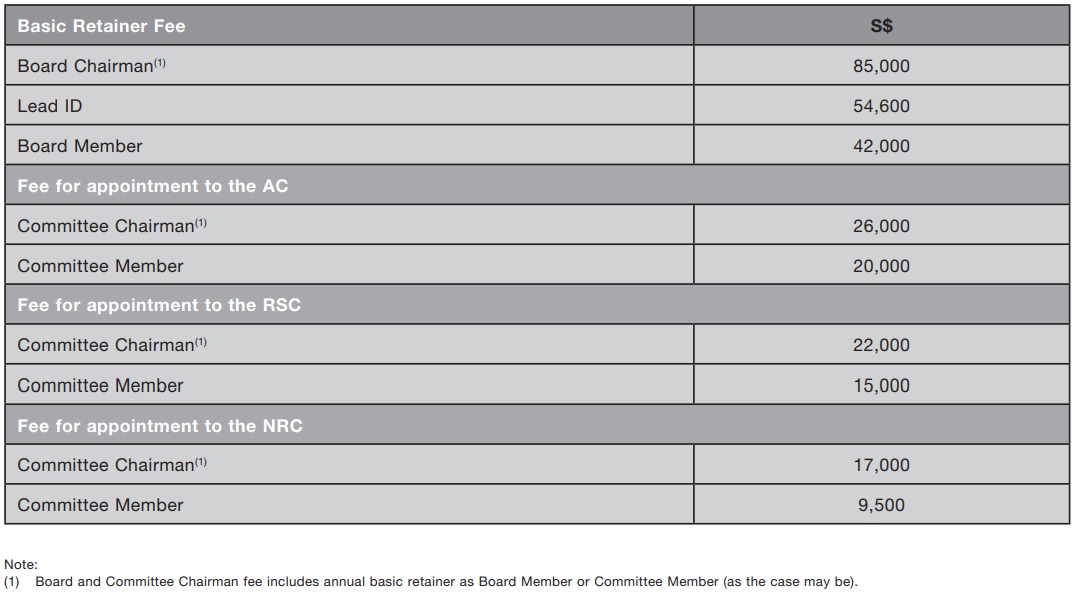

Remuneration policy and framework for non-executive Directors

The remuneration policy for our non-executive Directors is based on a scale of fees divided into basic retainer fees for serving as Director and additional fees for serving on Board Committees. The scale of fees takes into account the nature of the responsibilities of our Directors and the corresponding effort and time required as member of our Board and the relevant Board Committees.

The remuneration of non-executive Directors is reviewed to ensure that it is appropriate to attract and retain our Directors to provide good stewardship of our Company. The remuneration of non-executive Directors does not include any performance-related elements, and no performance conditions are attached to the share awards granted under the RSP to non-executive Directors as part of their remuneration in lieu of cash.

An external consultant is periodically engaged to benchmark the scale of fees against comparable companies listed on the SGX-ST. The benchmarking exercise was last performed in February 2024 when an external consultant, Aon, was engaged to recommend to our NRC and our Board the appropriate scale of fees. Aon had, among other things, advised on the appropriate scale of fees for our Board and our Board Committees, including our RSC which was established as a new Board Committee in July 2023.

Our NRC was formed in April 2024 from the combination of our previous Nominating Committee and Remuneration Committee. Our NRC deliberated and recommended that the scale of fees for Directors sitting on our NRC shall be pegged at the same level as the previous Remuneration Committee without any increase in the fees. It was noted that our previous Nominating Committee and Remuneration Committee had the same members, and in respect of FY2023, they had received fees only as members of our Remuneration Committee and had waived their fees for performing the functions of our Nominating Committee.

The scale of fees applicable for FY2024 is set out in Table 3 below.

Table 3: FY2024 – Scale of Fees

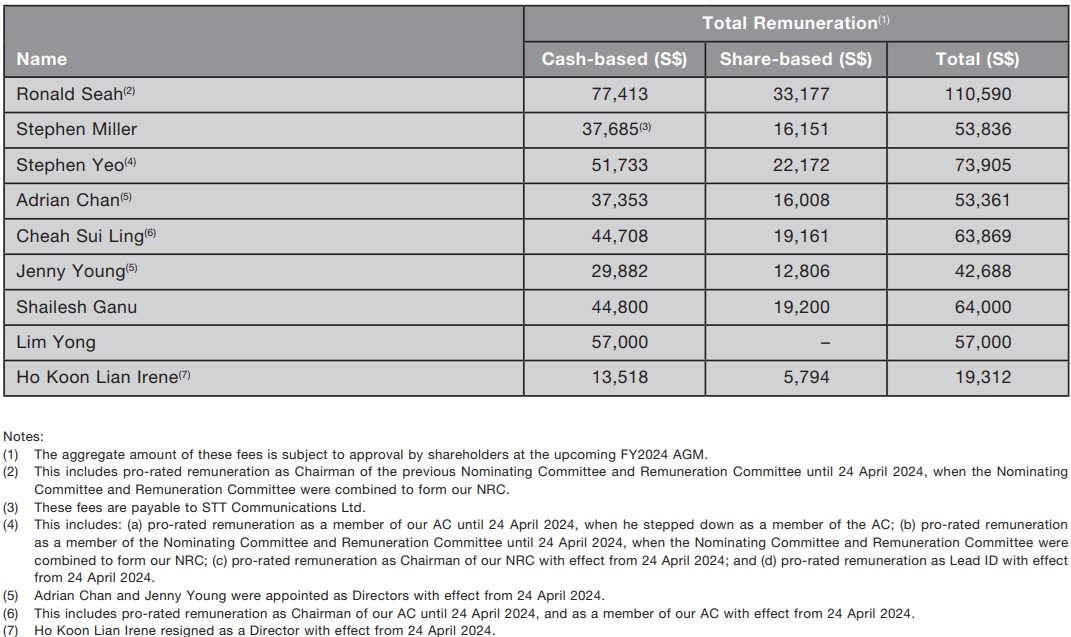

To align the interests of our Directors to that of our shareholders, non-executive Directors who served on our Board during FY2024 (other than Lim Yong, in respect of whom please see further below) will be remunerated as to approximately 70% of his/her total Director’s remuneration in cash and approximately 30% of his/her total Director’s remuneration in the form of a restricted share award pursuant to the TeleChoice RSP.

The number of shares to be awarded will be based on the volume-weighted average price (“VWAP”) of a share listed on the SGX-ST over the 14 market days commencing on (and including) the first ex-dividend date that immediately follows the date of this AGM (and in the event that no dividend is declared at such last concluded AGM, the VWAP of a share listed on the SGX-ST over the 14 market days commencing after the date of such last concluded AGM). The number of shares to be awarded will be rounded down to the nearest thousand shares, and any residual balance settled in cash.

The restricted share awards will consist of the grant of fully paid shares, without any performance or vesting conditions attached. However, in order to encourage alignment of interests of our Directors with the interests of shareholders, a Director is required to hold such number of shares equivalent to at least (a) the prevailing annual basic Board retainer fee, based on the VWAP of a share listed on the SGX-ST over the 14 market days from (and including) the first ex-dividend date (if any) following the date of our Company’s last concluded AGM (and in the event that no dividend is declared at such last concluded AGM, the VWAP of a share listed on the SGX-ST over the 14 market days commencing after the date of such last concluded AGM); or (b) the total number of shares awarded to that Director under the TeleChoice RSP (as amended) for FY2013 and onwards, whichever is lower. Notwithstanding the foregoing, a Director is permitted to dispose of all of his or her shares after the first anniversary of the date of his or her cessation as a Director of our Company.

It is proposed that the entire amount of the Director’s remuneration of Lim Yong for FY2024 be paid to him in cash in full. Lim Yong is the son, and therefore an associate, of Lim Chai Hock Clive, our controlling shareholder. As such, the approval of independent shareholders by way of a separate resolution for the grant of the specific number of share awards to Lim Yong is required under Rule 853 of the Listing Manual. However, as the number of share awards to be granted to Lim Yong would have been computed only after the date of the AGM (as described above), such number of awards would not be known until after the AGM, and it is therefore not possible to seek approval for the grant of the specific number of share awards to them at the AGM. In view of the difficulties that our Company would face in complying with Rule 853 of the Listing Manual for the grant of share awards to Lim Yong, our Company is therefore proposing to pay him in cash in full instead.

Remuneration of Non-Executive Directors

The exact amount and breakdown of the director’s fees of each non-executive Director for FY2024 are set out in Table 4 below. Our ED and President & CEO, Pauline Wong, is remunerated as Management and does not receive any director’s fees. The exact amount and breakdown of her remuneration for FY2024 are set out in the section “Remuneration of Management” above.

Table 4: FY2024 – Non-Executive Directors’ Remuneration

We will be seeking shareholders’ approval at the upcoming AGM for FY2024 for the remuneration to be paid to the non-executive Directors for FY2024 as set out in the above table. Further information on this proposal is provided in the Notice of AGM dated 4 April 2025.

(C) Accountability and Audit

Principle 9: Risk Management and Internal Controls

The Board is responsible for the governance of risk and ensures that Management maintains a sound system of risk management and internal controls, to safeguard the interests of the company and its shareholders.

Overall responsibility

Our Board has overall responsibility for the management of risks, including the determination of the nature and extent of the significant risks which our Company is willing to take in achieving its strategic objectives and value creation.

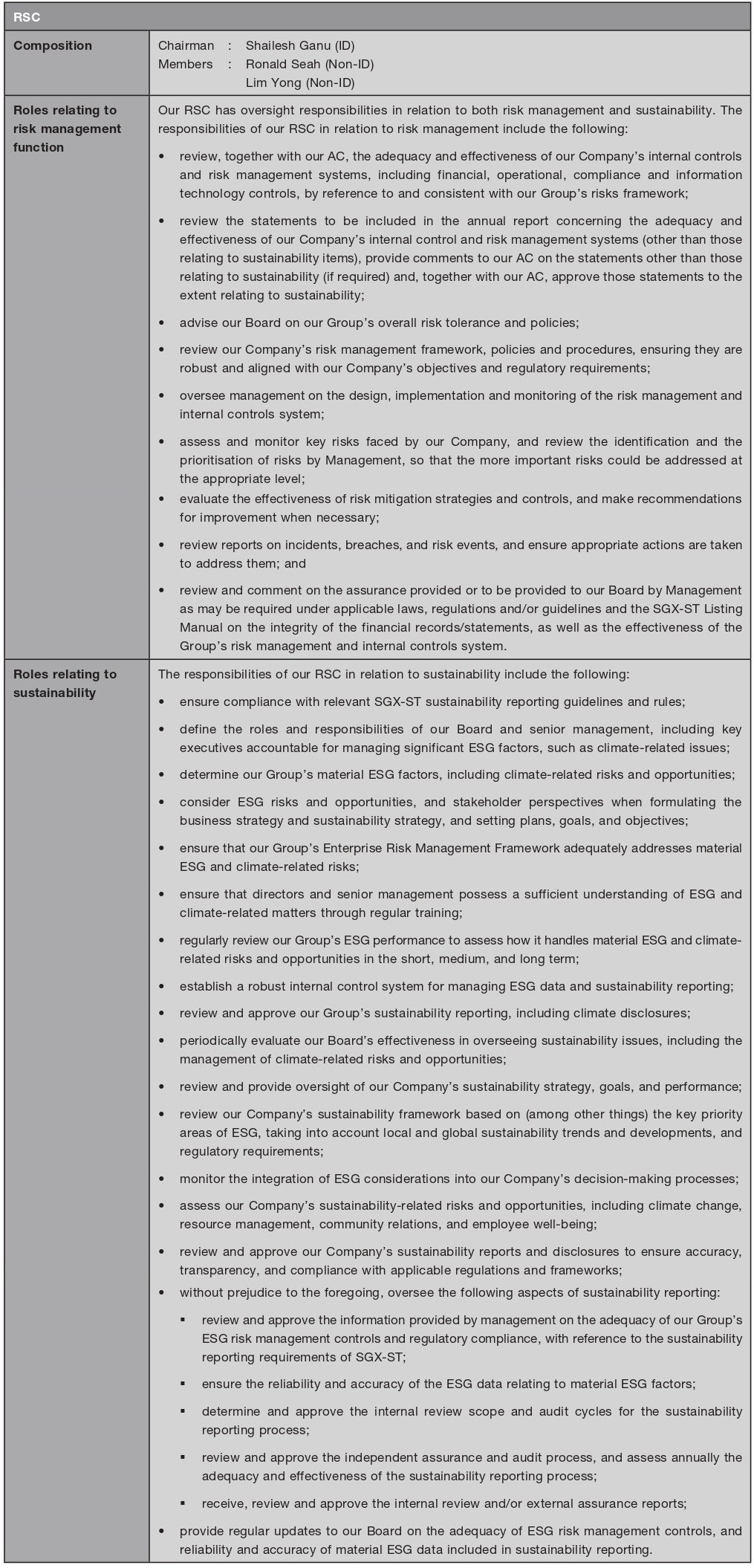

RSC composition and role

In July 2023, our Board established the RSC as a new Board Committee to assist our Board in fulfilling its oversight responsibilities in relation to risk management, with concurrent responsibility for sustainability. We are committed to growing our business in a sustainable manner with a view to achieving the long-term success of our Company and value creation for our shareholders. The establishment of the RSC reflects the emphasis placed on sustainability, and enables our Board to have a more holistic view of, and integrated approach to, managing sustainability and the governance of risks. Our RSC will also work together with our AC to review the adequacy and effectiveness of our Company’s internal controls and risk management systems, including financial, operational, compliance and information technology controls, with our AC focusing primarily on financial-reporting risks.

Our RSC comprises three (3) members, all of whom are non-executive Directors. The Chairman of our RSC is an ID, with the remaining members being Non-IDs.

Our RSC is guided by the terms of its written charter. All decisions at any RSC meeting are decided by a majority of votes of RSC members present and voting (the decision of our RSC shall at all times exclude the vote, approval or recommendation of any member having a conflict of interest in the subject matter under consideration).

During FY2024, our RSC held two (2) meetings. The key activities performed by our RSC in FY2024 included, among other things: (a) reviewing the risks framework, ranking of risks and mitigating measures under the Group Board Assurance Framework on a half-yearly basis; (b) reviewing certain internal audit findings highlighted to its attention by our AC; (c) reviewing and approving the internal audit report relating to sustainability; (d) reviewing and approving the sustainability report for FY2023; and (e) reviewing the materiality targets for FY2024.

Risks management and internal controls

Our Group has in place an Enterprise Risk Management (“ERM”) Framework, which governs the process of identification, prioritisation, assessment, management and monitoring of key financial, operational, compliance and IT risks to our Group. The key risks of our Group are deliberated by Management and reported to our RSC. Integral to the ERM Framework is a Group-wide system of internal controls.

Our Board, with the advice of our RSC, determines our Group’s level of risk tolerance and risk policies and our RSC and AC oversee Management in the design, implementation and monitoring of the risk management and internal control systems. Our Board, our RSC and our AC are supported by Management and independent professional service providers such as external and internal auditors to review the adequacy and effectiveness of our Group’s risk management and internal controls systems.

As part of the risk management process, Management will prepare a Group Board Assurance Framework which identifies the key risk factors that are faced by our Group in our business and operations, categorise them according to financial, operations, compliance and IT risks, rank the risk factors in terms of their relative importance, likelihood of occurrence and potential impact to our Group should such risks materialise, and implement the internal controls and other risk mitigating practices which may be in place to address such risks. The Group Board Assurance Framework is reviewed, considered and approved by our RSC at least on a half-yearly basis and as and when it becomes necessary to do so.

Management, under the supervision of our RSC, is responsible for the effective implementation of risk management strategies, policies and processes based on the Group Board Assurance Framework to facilitate the achievement of business plans and goals. Key risks, mitigating measures and management actions are continually identified, reviewed and monitored by Management.

Our internal auditors, Ernst & Young Advisory Pte. Ltd. (“IA”), conducts audits that involve testing the effectiveness of the material internal control systems within our Group, relating to financial, operations, compliance and IT risks. Any material non-compliance or lapses in internal controls are reported to our AC and RSC (as appropriate), including the remedial measures recommended to address the risks identified. Our AC and RSC (as appropriate) also review the adequacy and timeliness of the actions taken by Management in response to the recommendations made by our IA. To facilitate their work, our IA is invited to attend all AC meetings so that they would be familiar with the business and operations of our Group and better understand the key risks faced by our Group and concerns of our AC. Our AC will work together with our RSC, where necessary, to address any issues identified in the course of the internal audit. In addition, control self-assessment in respect of the key risk factors identified in the Group Board Assurance Framework is conducted by Management on a periodic basis to evaluate the adequacy and effectiveness of the risk management and internal control systems.

Our Board, with the concurrence of our RSC and our AC, commented that our Group’s internal controls and risk management systems are adequate and effective in addressing the financial, operational, compliance and IT risks of our Group. Our Board acknowledges that it is responsible for our Group’s overall risk management and internal control system framework, but recognises that there is no system that will preclude all errors and irregularities, as a system is designed to manage rather than eliminate the risk of failure to achieve business objectives, and can provide only reasonable and not absolute assurance against material misstatement or loss.

Assurances from Management

Our Board has received assurances from:

- the ED and President & CEO and the Chief Financial Officer (“CFO”) that the financial records have been properly maintained and the financial statements give a true and fair view of our Group’s operations and finances; and

- the ED and President & CEO and other relevant key management personnel that our Group’s risk management and internal control systems are effective and adequate.

Principle 10: Audit Committee

The Board has an Audit Committee (“AC”) which discharges its duties objectively.

AC composition and role

Our AC comprises three (3) members, all of whom (including the Chairman) are IDs, and is able to discharge its duties objectively.

Whilst the Chairman of our AC is a lawyer by training, he has significant accounting/financial management knowledge and experience taking into account, among other things: (a) his background as a corporate lawyer for 35 years, and as the Head of Corporate Department and Senior Partner at Lee & Lee; (b) that he has been a director on the boards of many listed companies and other entities over many years; and (c) that he has sat on the audit committee of many of these companies and other entities and had previously served as chairman on some of them, including as Chairman, Audit and Risk Management Committee of the Accounting and Corporate Regulatory Authority and Chairman, Audit and Risk Committee of Ascendas Funds Management (S) Limited (as manager of Ascendas REIT).

The remaining two (2) members of our AC have accounting/finance background. Cheah Sui Ling has over 20 years of international investment banking and corporate experience, while Jenny Young is a chartered accountant and has 30 years of experience in finance, audit and accounting.

Our AC does not comprise members who were partners or directors of the incumbent external auditors, KPMG LLP, within the period of two (2) years commencing on the date of their ceasing to be a partner or director of KPMG LLP. Our AC also does not comprise any member who has any financial interest in KPMG LLP.

Our AC is guided by the terms of its written charter. All decisions at any AC meeting are decided by a majority of votes of AC members present and voting (the decision of our AC shall at all times exclude the vote, approval or recommendation of any member having a conflict of interest in the subject matter under consideration).

Our AC has separate and independent access to the external and internal auditors, without the presence of our ED and President & CEO and other Senior Management members, in order to have free and unfettered access to information that our AC may require.

Our AC has full authority to commission and review findings of internal investigations into matters where there is any suspected fraud or irregularity or failure of internal controls or violation of any law likely to have a material impact on our operating results. Our AC is also authorised to investigate any matter within its charter with the full co-operation of Management. Our AC reviews and approves the half-yearly and annual financial statements and the appointment and re-appointment of the external auditors before recommending them to our Board for approval, and approves the appointment of the IA.

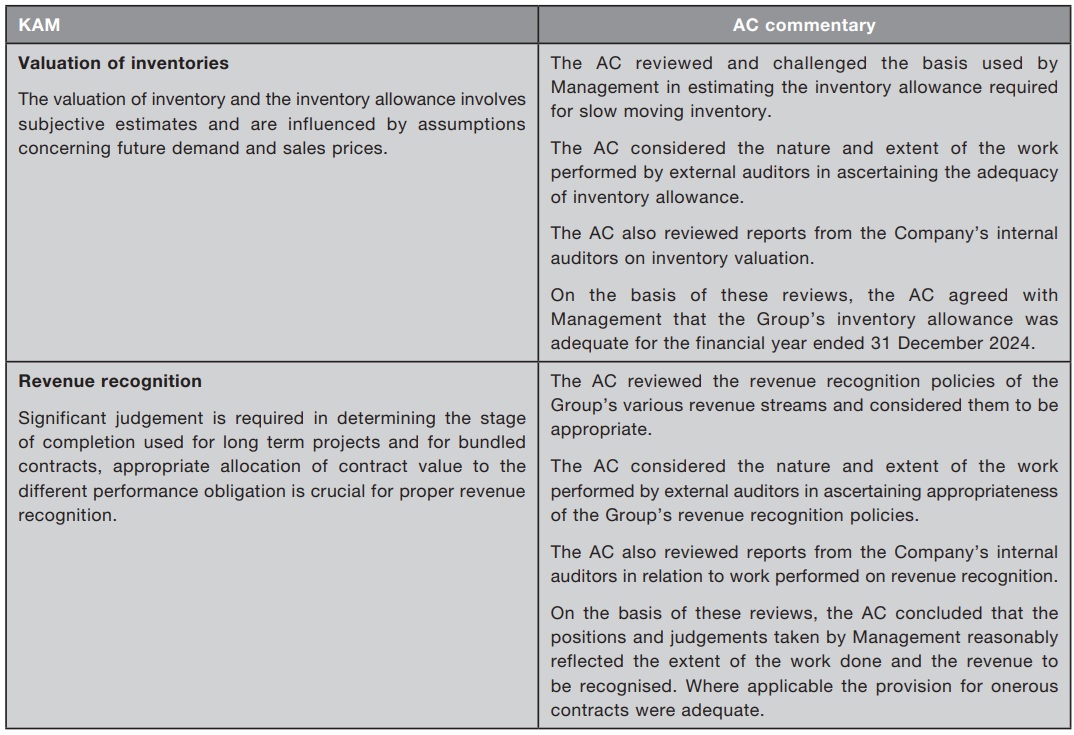

In FY2024, our AC held five (5) meetings. The key activities performed by our AC in FY2024 included: (a) reviewing our Group’s full year and half-yearly financial statements and first and third quarter business performance update; (b) reviewing and deliberating on the key audit matters; (c) reviewing the internal audit report from the IA; (d) reviewing, with the external auditors, their evaluation of the effectiveness and adequacy of the system of internal accounting and financial controls; (e) reviewing, together with the RSC, the adequacy and effectiveness of our Company’s internal controls and risk management systems; and (f) reviewing interested person transactions entered into by our Group. Our AC also met with the external and internal auditors without the presence of Management, at least once in FY2024, to discuss matters it believes should be raised privately.

External auditors