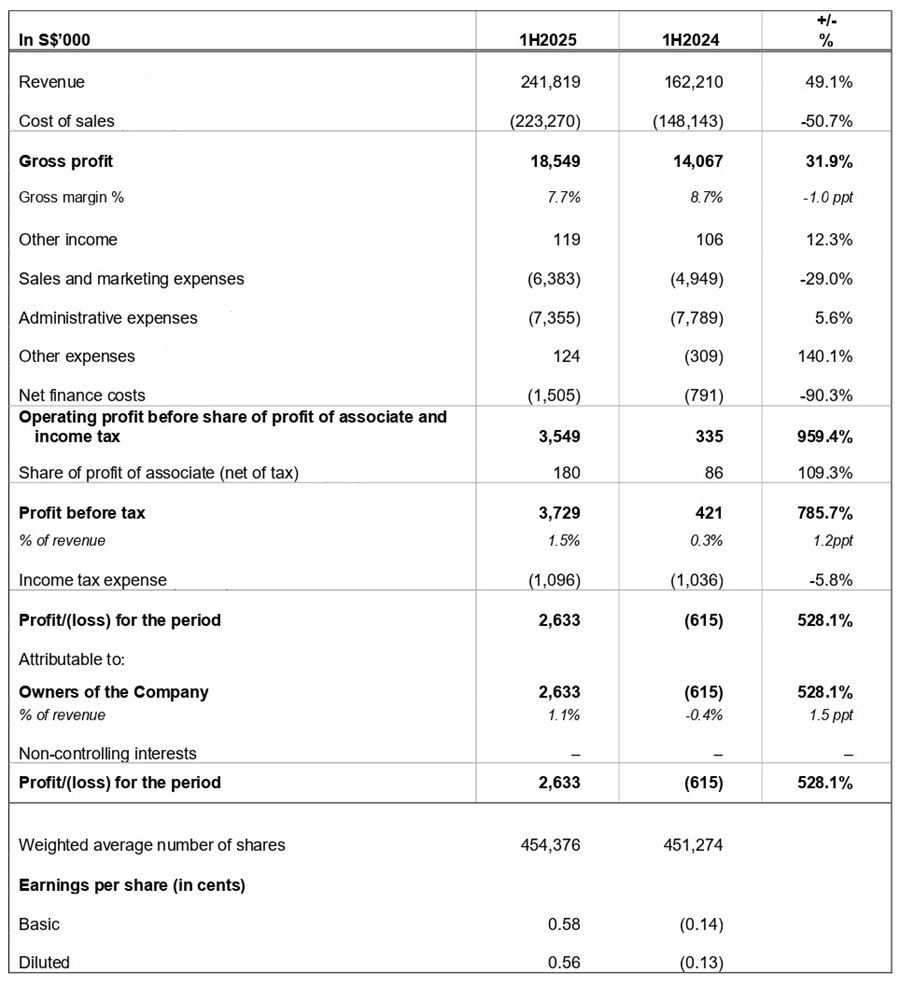

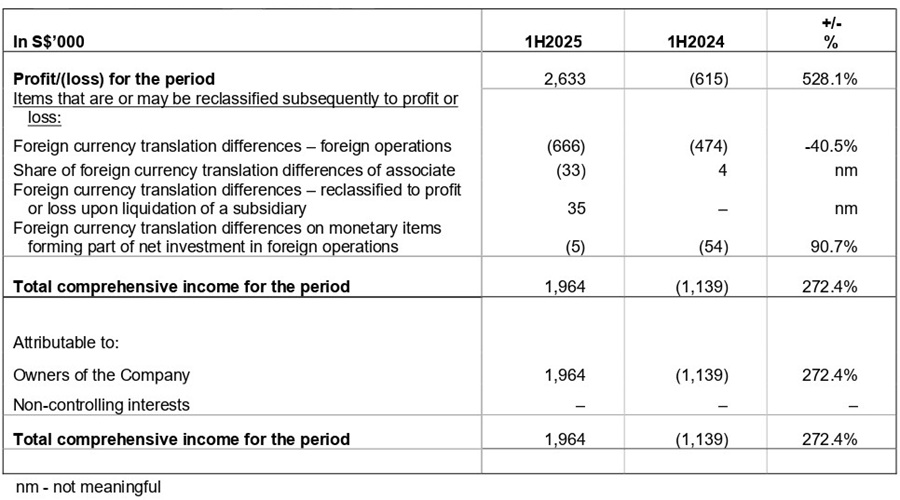

Condensed Interim Consolidated Statement of Profit or Loss and Other Comprehensive Income for Period ended 30 June 2025

Consolidated Statement of Profit or Loss

Consolidated Statement of Other Comprehensive Income

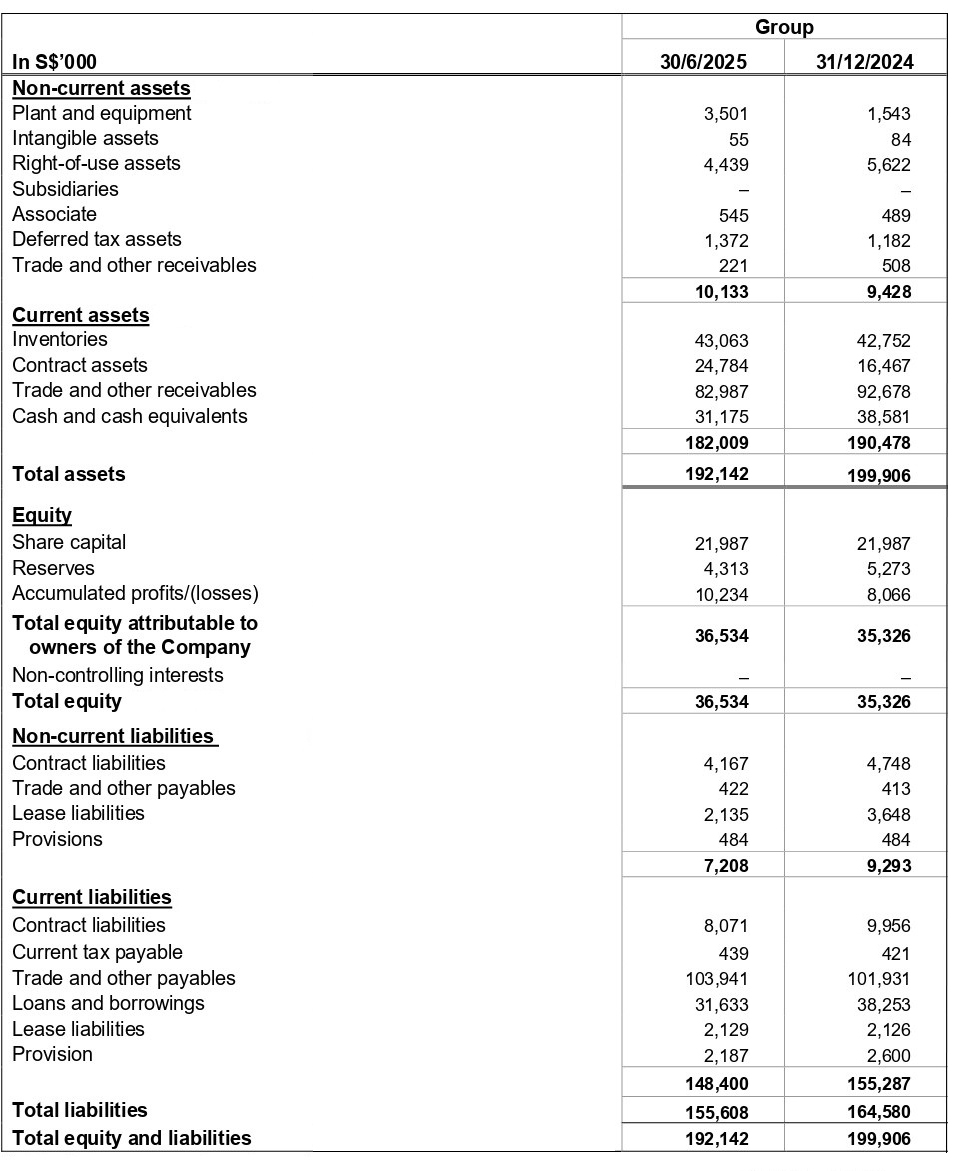

Condensed Interim Statements of Financial Position As at 30 June 2025

Review of Group Performance

The Group registered revenue of S$241.8 million in 1H2025, a 49.1% increase as compared to S$162.2 million in 1H2024, with all divisions recording higher revenue in 1H2025. The Group recorded a profit before tax of S$3.7 million as compared to profit before tax of S$0.4 million in 1H2024. All Divisions reported a significant improvement in profit in 1H2025. The higher gross profit in 1H2025 was partially offset by higher sales and marketing expenses and financing expenses to support the increase in sales activities.

PCS Division recorded a revenue of S$163.8 million in 1H2025, an increase of 63.7% against 1H2024. The increase in revenue was from both its Singapore and Malaysian operations. Although a lower gross margin was recorded in 1H2025 due to higher sales of mobile phones in 1H2025, gross profit had increased year-on-year resulting in a profit before tax of S$2.6 million being reported in 1H2025 as compared to a profit before tax of S$1.6 million in 1H2024. The Malaysian operations continued to be a significant profit contributor and had recorded higher profit before tax due to higher revenue recognised from the 4PL fulfilment and managed services contract signed with U Mobile in February 2024. The Singapore operations recorded higher losses in 1H2025 as compared to 1H2024 mainly due to higher sales and marketing expenses incurred to increase its customer base in Singapore. There was also higher financing costs incurred to finance the working capital requirement to support the increase in sales activities in both Singapore and Malaysia.

ICT Division recorded a revenue of S$47.1 million in 1H2025, an increase of 47.7% against 1H2024. The increase in revenue was from its IT business. Although a lower gross margin was recorded in 1H2025 due to higher sales of hardware and software, gross profit had increased year-on-year resulting in an operating profit before share of profit of associate and tax of S$0.6 million being reported in 1H2025 as compared to an operating loss before share of profit of associate and tax of S$1.5 million in 1H2024. Both IT and Communications business achieved a turnaround from a loss to a profit in 1H2025. The improvement for the Communication business in 1H2025 was attributed to a higher gross margin and lower staff related costs. The turnaround in IT business was contributed by both its Digital Infrastructure and Tech & Apps Services business. The higher net profit from its Digital Infrastructure business was due to an increase in revenue in 1H2025 while for the Tech & Apps Services business a lower loss was recorded in 1H2025 due to variation orders received and completion of various longterm projects.

NES Division recorded a revenue of S$30.9 million in 1H2025, an increase of 2.2% against 1H2024. The increase in revenue was mainly from its Singapore operations. Although gross profit and gross margin were lower in 1H2025, a higher profit before tax of S$0.3 million in 1H2025 was recorded as compared to a profit before tax of S$0.2 million in 1H2024. The improvement was mainly due to reduced losses from the Singapore operations, partially offset by a lower profit recognition from its Indonesian operations. The Indonesian operations continued to be the main profit contributor for both periods. The lower profit from the Indonesian operations was mainly due to initial investment costs for the new managed service contract secured in 1H2025 resulting in lower gross margin. The improvement from the Singapore operations was largely due to higher revenue and higher gross margin from its structured cabling business.

The Group recorded a net cash inflow from its operating activities in 1H2025 due to operating profit for the period, partially offset by negative changes in working capital and payment of income tax. As of 30 June 2025, the Group’s net debt position was S$0.5 million mainly due to new bank loans secured to finance the working capital required to support the new managed service contracts in Indonesia.

Prospects

While Singapore delivered GDP growth year-on-year, growth is projected to be moderate in the second half of 2025. The Monetary Authority of Singapore (MAS) added that both the global and local economies remain subject to significant uncertainty for the rest of 2025 and 2026. Nevertheless, certain markets and sectors may continue to show resilience, supported by steady domestic demand and growing adoption of digital services, particularly in artificial intelligence (AI), data centres, and cloud infrastructure.

The Group remains cautiously optimistic, building on its strong first-half momentum to capture continued opportunities in consumer fulfilment, ICT solutions, and network engineering services. In spite of the short-term challenges outlined above, accelerating demand for digital infrastructure and AI-driven technologies present new opportunities for expansion and value creation.

The Group remains committed to its five-year transformation roadmap to renew, rebuild and transform. In FY2025, we continue to execute a multi-pronged strategy encompassing digital transformation, operational efficiency, and strengthened governance, underpinned by prudent resource management and financial discipline. With a differentiated portfolio, strong execution, and a customer-centric approach, the Group is well-positioned to navigate challenges, build resilience, and deliver sustainable long-term growth.

This release may contain forward-looking statements that involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other companies and venues for the sale/distribution of goods and services, shifts in customer demands, customers and partners, changes in operating expenses, including employee wages, benefits and training, and governmental and public policy changes. You are cautioned not to place undue reliance on these forward-looking statements, which are based on current view of management on future events.