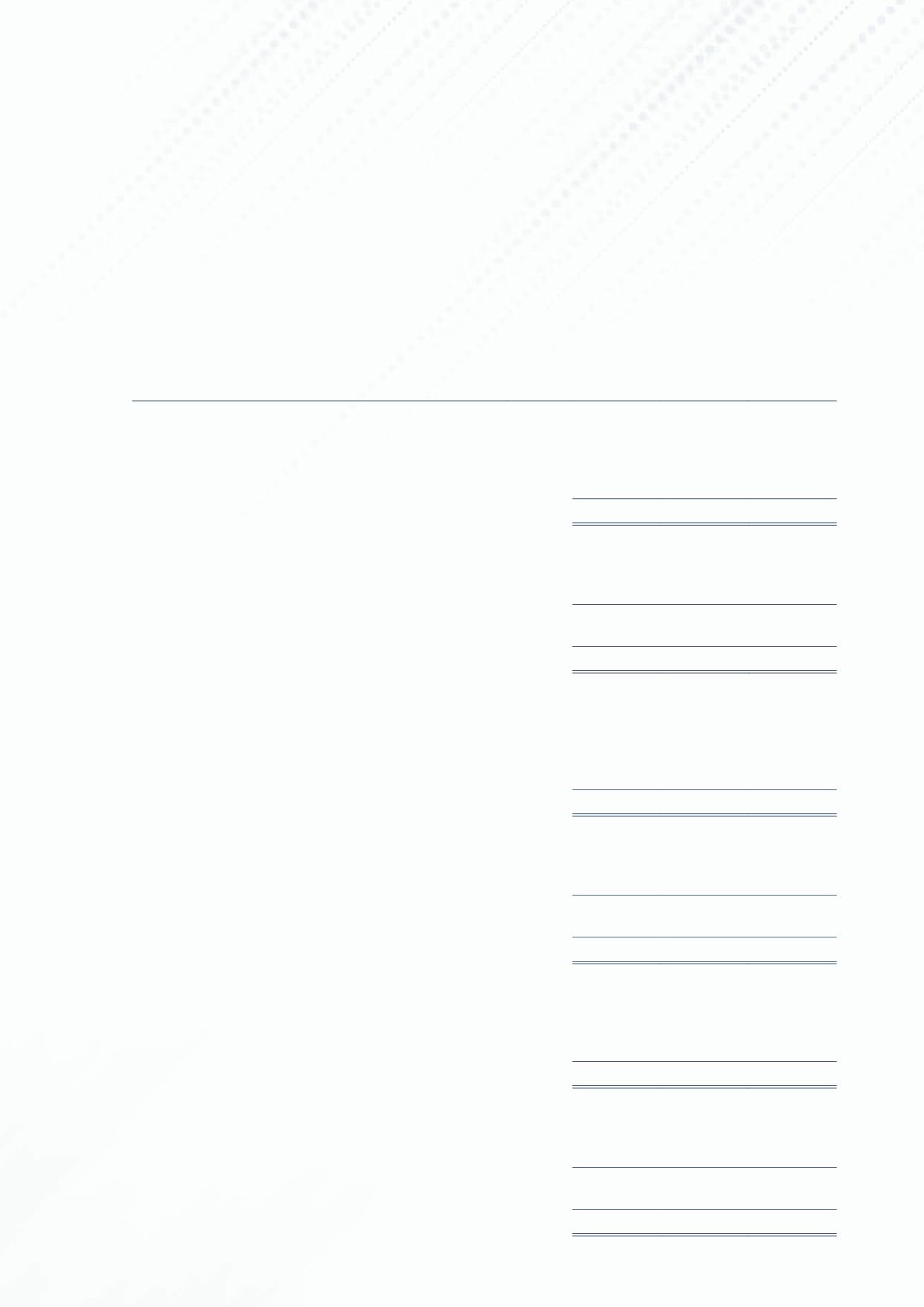

32 FINANCIAL RISK MANAGEMENT

(continued)

Accounting classifications

(continued)

Note

Loans and

receivables

Other

financial

liabilities

Total

carrying

amount

$’000

$’000

$’000

31 December 2014

Financial assets not measured at fair value

Trade and other receivables

11

96,071

–

96,071

Cash and cash equivalents

16

37,986

–

37,986

134,057

–

134,057

Financial liabilities not measured at fair value

Accrued contingent consideration

19

–

6,300

6,300

Trade and other payables

–

81,935

81,935

20

–

88,235

88,235

Loans and borrowings

21

–

19,968

19,968

–

108,203

108,203

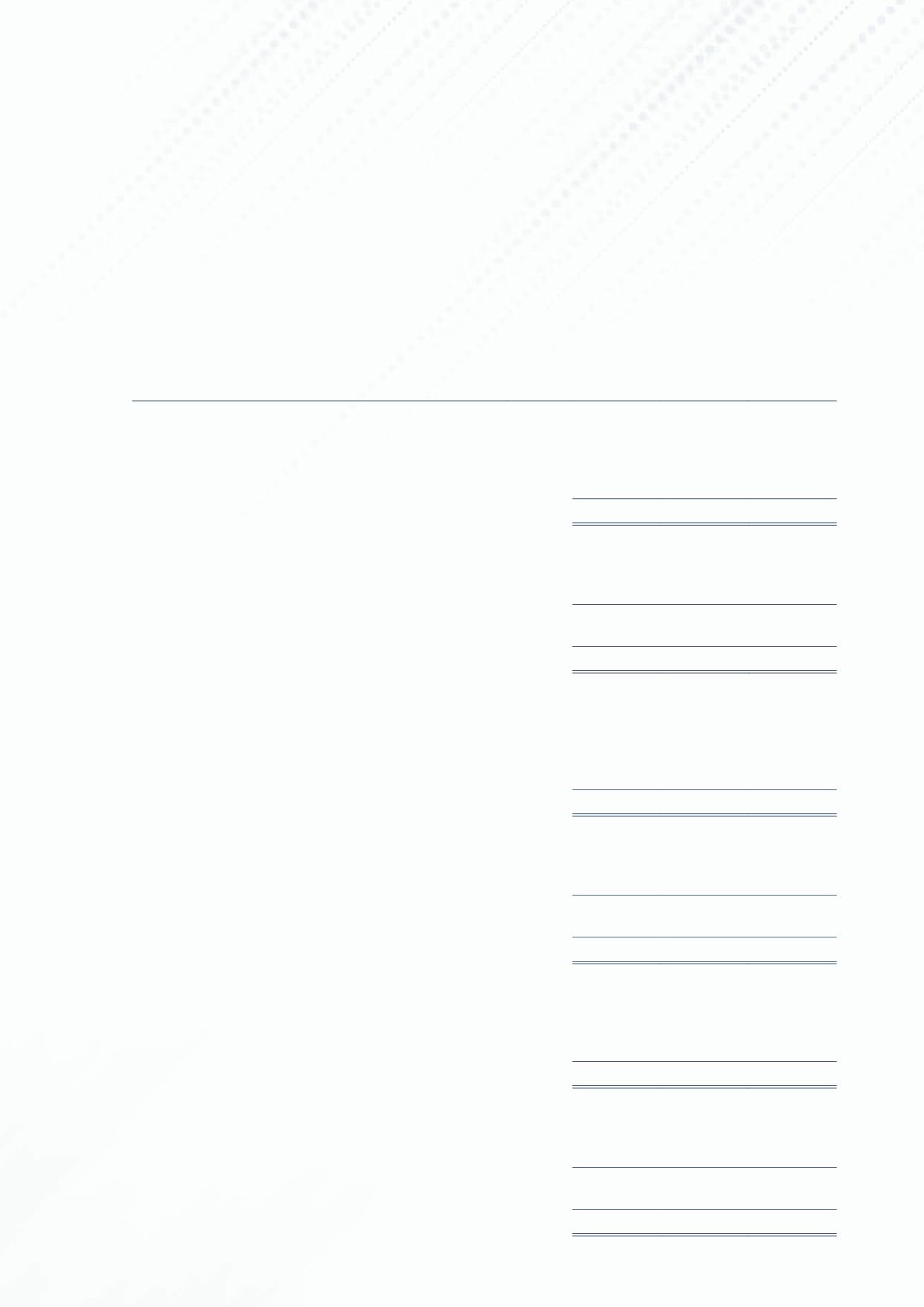

Company

31 December 2015

Financial assets not measured at fair value

Trade and other receivables

11

24,822

–

24,822

Cash and cash equivalents

16

14,371

–

14,371

39,193

–

39,193

Financial liabilities not measured at fair value

Accrued contingent consideration

19

–

163

163

Trade and other payables

–

37,575

37,575

20

–

37,738

37,738

Loans and borrowings

21

–

9,987

9,987

–

47,725

47,725

31 December 2014

Financial assets not measured at fair value

Trade and other receivables

11

44,970

–

44,970

Cash and cash equivalents

16

11,901

–

11,901

56,871

–

56,871

Financial liabilities not measured at fair value

Accrued contingent consideration

19

–

6,300

6,300

Trade and other payables

–

35,638

35,638

20

–

41,938

41,938

Loans and borrowings

21

–

10,000

10,000

–

51,938

51,938

117

TELECHOICE INTERNATIONAL LIMITED

2015 ANNUAL REPORT

NOTES TO THE

FINANCIAL STATEMENTS