36

TELECHOICE INTERNATIONAL LIMITED

2015 ANNUAL REPORT

CORPORATE

GOVERNANCE

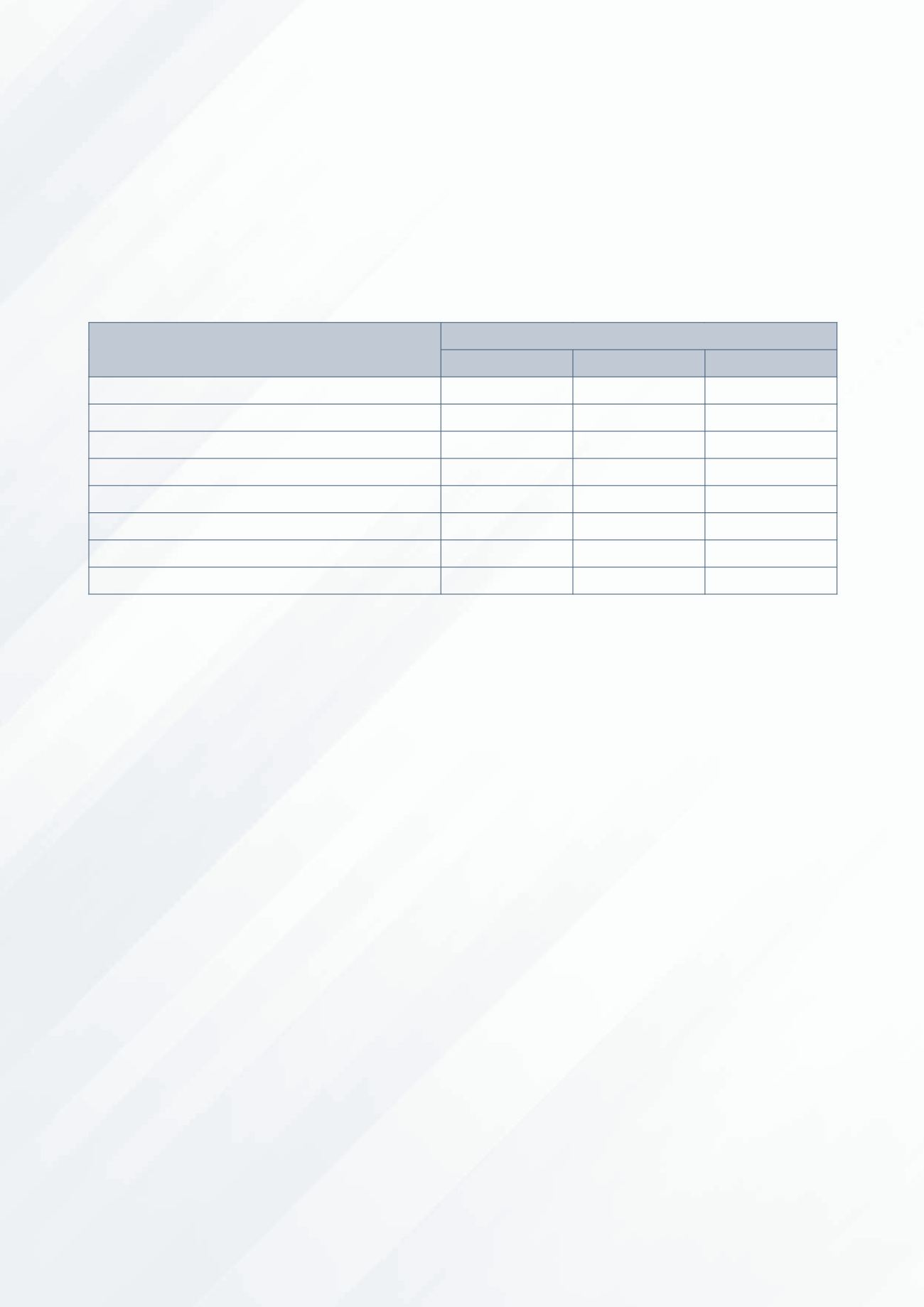

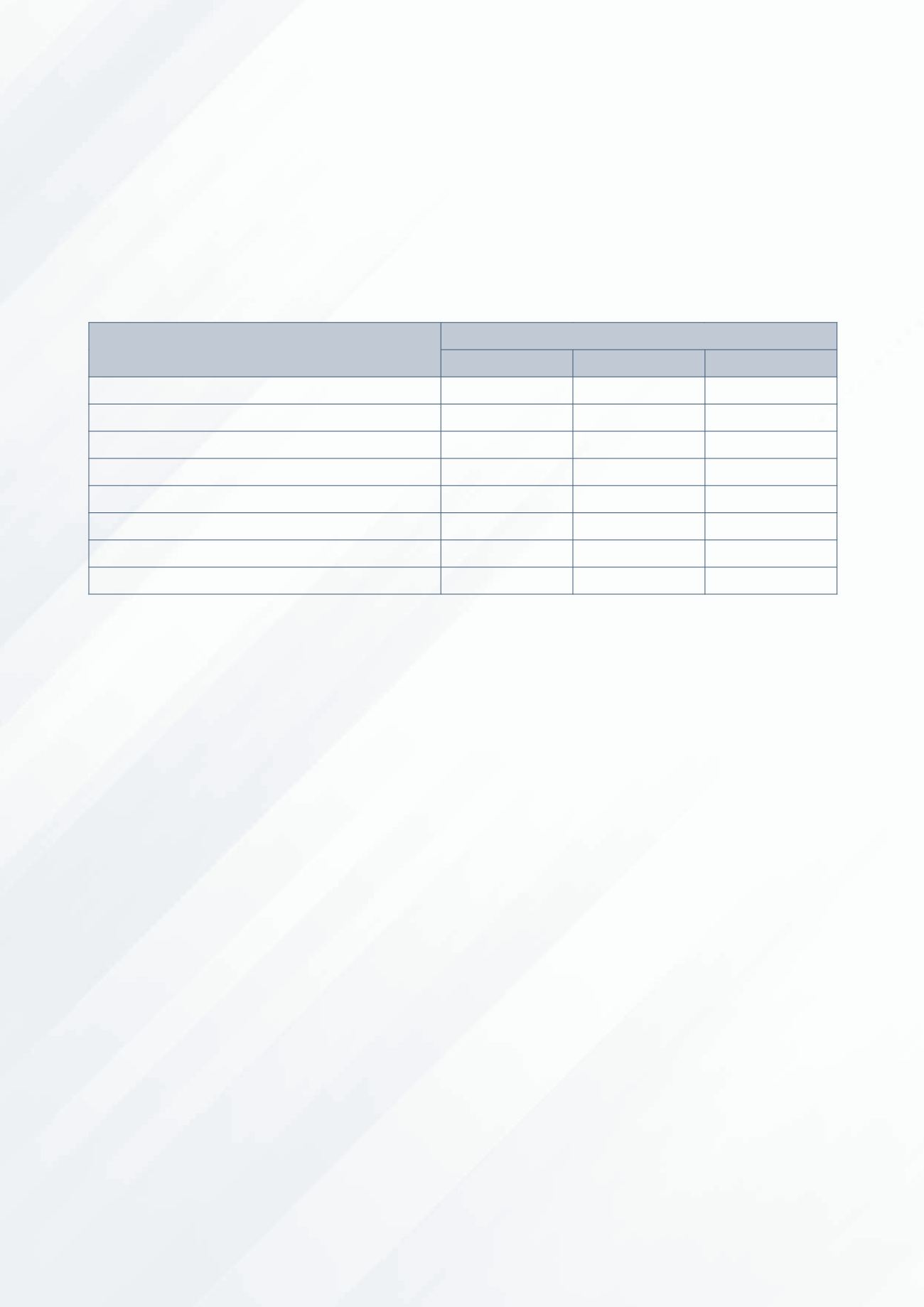

The following Table 4 shows the total composition of Directors’ remuneration for FY15.

Table 4: FY15 – Directors’ Remuneration

Name

Total Directors’ Remuneration

(1)

Cash-based

Share-based

Total

Bertie Cheng

$72,100

$30,900

$103,000

Yap Boh Pin

$49,700

$21,300

$71,000

Yen Se-Hua Stewart

(3)

$24,150

$10,350

$34,500

Tang Yew Kay Jackson

$39,900

$17,100

$57,000

Ronald Seah Lim Siang

$30,450

$13,050

$43,500

Sio Tat Hiang

$42,700

(2)

$18,300

$61,000

Ho Koon Lian Irene

(4)

$28,525

(2)

$12,225

$40,750

Lim Chai Hock Clive

$30,100

$12,900

$43,000

Notes:–

(1)

The aggregate amount of these fees is subject to approval by shareholders at the upcoming AGM for FY15.

(2)

These fees are payable to STT Communications Ltd.

(3)

Yen Se-Hua Stewart resigned as a Director, the Chairman of the NC and a member of the RC and EC with effect from 5 May 2015.

(4)

Ho Koon Lian Irene was appointed as a Director and a member of the AC with effect from 5 May 2015.

From FY14, the Company has implemented a contractual “Clawback” provision in the event that the executive Director or Key

Management Personnel of the Company engages in fraud or misconduct, which results in re-instatement of the Company’s financial

results or a fraud/misconduct resulting in financial loss to the Company. The Board may pursue to reclaim the unvested components of

remuneration from the executive Director or key management personnel from all incentive plans for the relevant period, to the extent

such incentive has been earned but not yet released or disbursed. The Board, taking into account the RC’s recommendation, can decide

whether and to what extent, such recoupment of the incentive is appropriate, based on the specific facts and circumstances of the case.

(C)

ACCOUNTABILITY AND AUDIT

Principle 10: Accountability

We have always believed that we should conduct ourselves in ways that deliver maximum sustainable value to our shareholders. We

promote best practices as a means to build an excellent business for our shareholders. Our Board has overall accountability to our

shareholders for our performance and in ensuring that we are well managed. Management provides our Board members with monthly

business and financial reports, comparing actual performance with budget and highlighting key business indicators and major issues

that are relevant to our performance, position and prospects.

Principle 11: Risk Management and Internal Controls

The Company and its subsidiaries (the “

Group

”) has in place an Enterprise Risk Management (“

ERM

”) Framework, which governs the

process of identification, prioritisation, assessment, management and monitoring of key financial, operational, compliance and IT risks

to the Group. The key risks of the Group are deliberated by Management and reported to the AC. Integral to the ERM is a Group-wide

system of internal controls.