43

TELECHOICE INTERNATIONAL LIMITED

2015 ANNUAL REPORT

GROUP FINANCIAL

REVIEW

1.5 Exceptional items

Exceptional items comprises of loss on disposal of a joint venture of $0.4 million and additional contingent consideration of

$0.2 million.

Loss on disposal of a joint venture was related to the disposal of a foreign joint venture. The loss arose from reclassification

of exchange reserve to income statement.

Additional contingent consideration was relating to the Tranche 2 consideration payable on acquisition of NxGen.

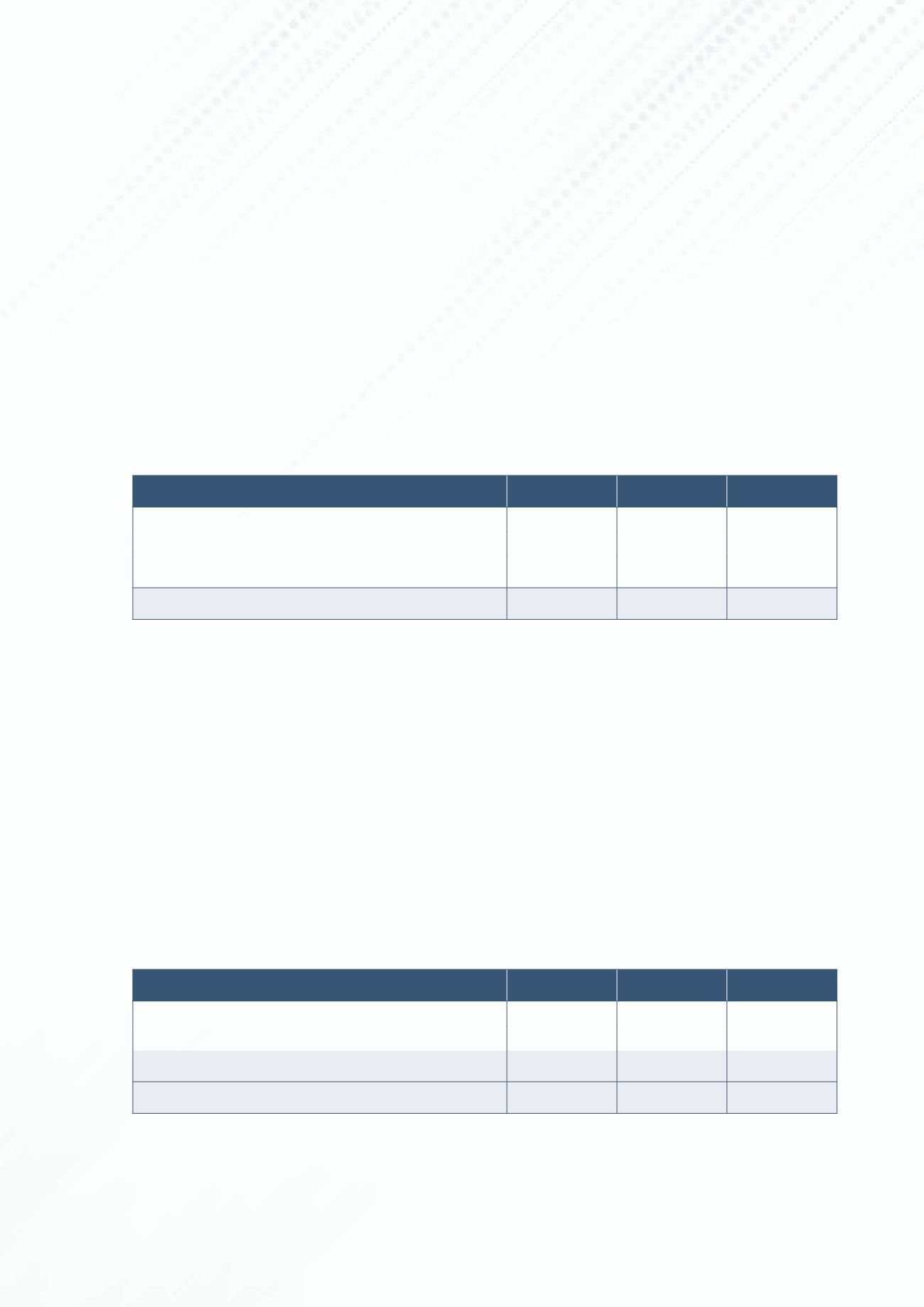

1.6 Operating profit before tax

Operating profit before tax margins

FY2015

FY2014

Change

PCS

1.8%

1.9%

-0.1 ppt

ICT

1.4%

1.0%

0.4 ppt

Engineering

6.3%

7.0%

-0.7 ppt

Group

2.2%

2.2%

0.0 ppt

Group operating PBT increased by 12% to $12.8 million in FY2015. PBT margins maintained at 2.2% for both periods. Against

FY2014, ICT recorded increase in PBT margins whilst both PCS and Engineering recorded decrease in PBT margins.

PCS

contributed to 60% of group operating PBT in FY2015 (FY2014: 60%). PBT increased by 13% or $0.9 million to $7.7 million

in FY2015 due to higher profit contribution from Singapore operations. The weakening of the Malaysian Ringgit has impacted

the profit contribution from Malaysia.

ICT

contributed to 12% of group operating PBT in FY2015 (FY2014: 9%). PBT increased by 50% or $0.5 million to $1.5 million in

FY2015 due to lower operating expenses partially offset by lower gross profits. Excluding the amortisation of intangible assets

arising from the acquisitions and interest accretion, operating PBT for FY2015 and FY2014 maintained at $2.5M.

Engineering

contributed to 28% of group operating PBT in FY2015 (FY2014: 31%). PBT was maintained at $3.6 million in

FY2015. Higher profit contribution from Indonesia despite the translation loss due to the weakening of the Indonesian Rupiah

was partially offset by losses from the Malaysian operations.

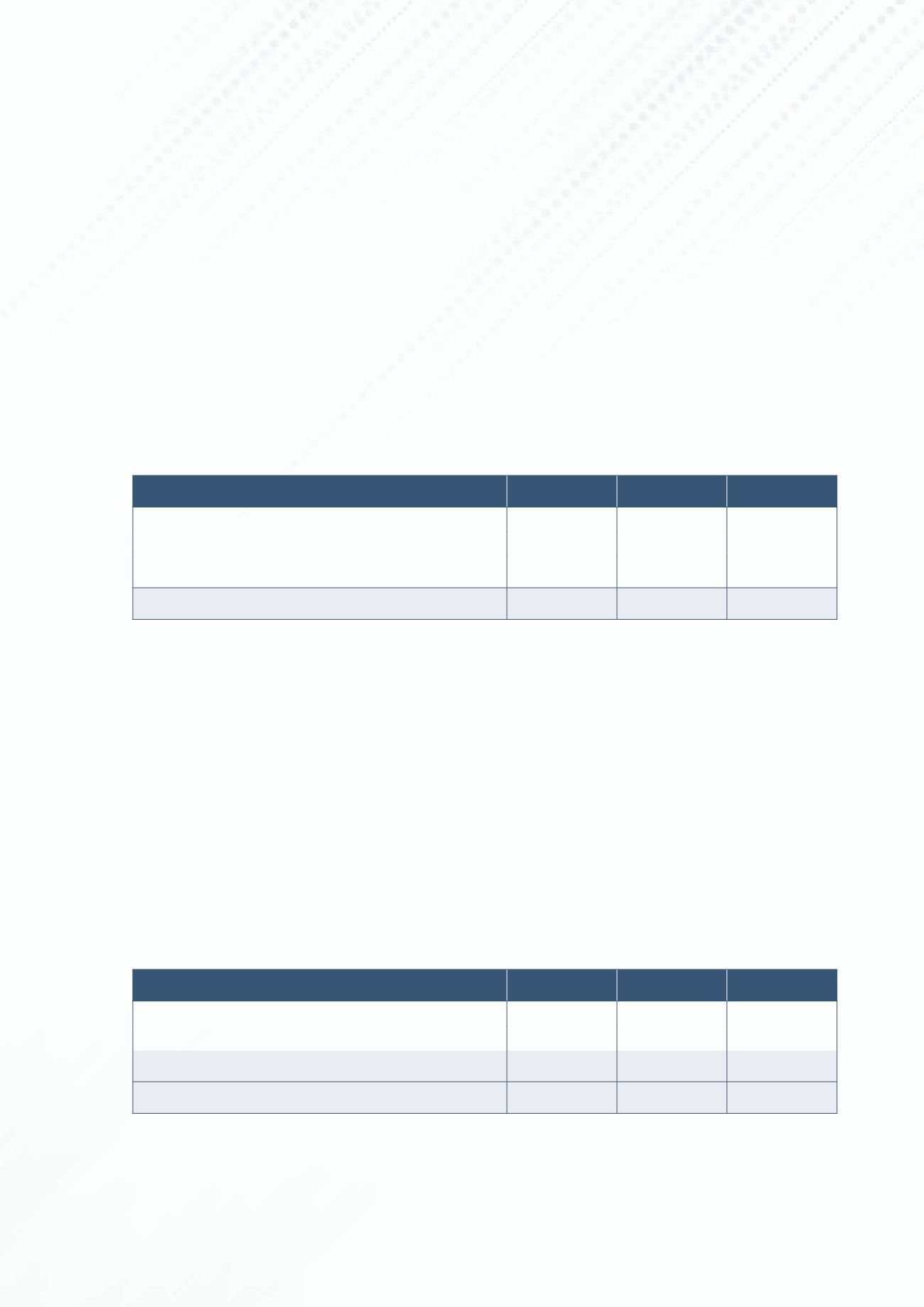

1.7 Profit after tax and non-controlling interests

In $ million

FY2015

FY2014

Change (%)

Income tax expenses

2.1

2.2

-5%

Effective tax rate

17.2%

19.3%

-1.7 ppt

Profit after tax and non-controlling interests

10.3

9.4

10%

Profit after tax margins

1.8%

1.8%

0.0 ppt

Group

PATMI

increased by 10% to $10.3 million in FY2015.

Income tax expenses

were lower than the previous financial year by 5% or $0.1 million. The lower effective tax rate in FY2015

was mainly due to lower profit contribution from overseas entities that have higher statutory tax rates.