41

TELECHOICE INTERNATIONAL LIMITED

2015 ANNUAL REPORT

GROUP FINANCIAL

REVIEW

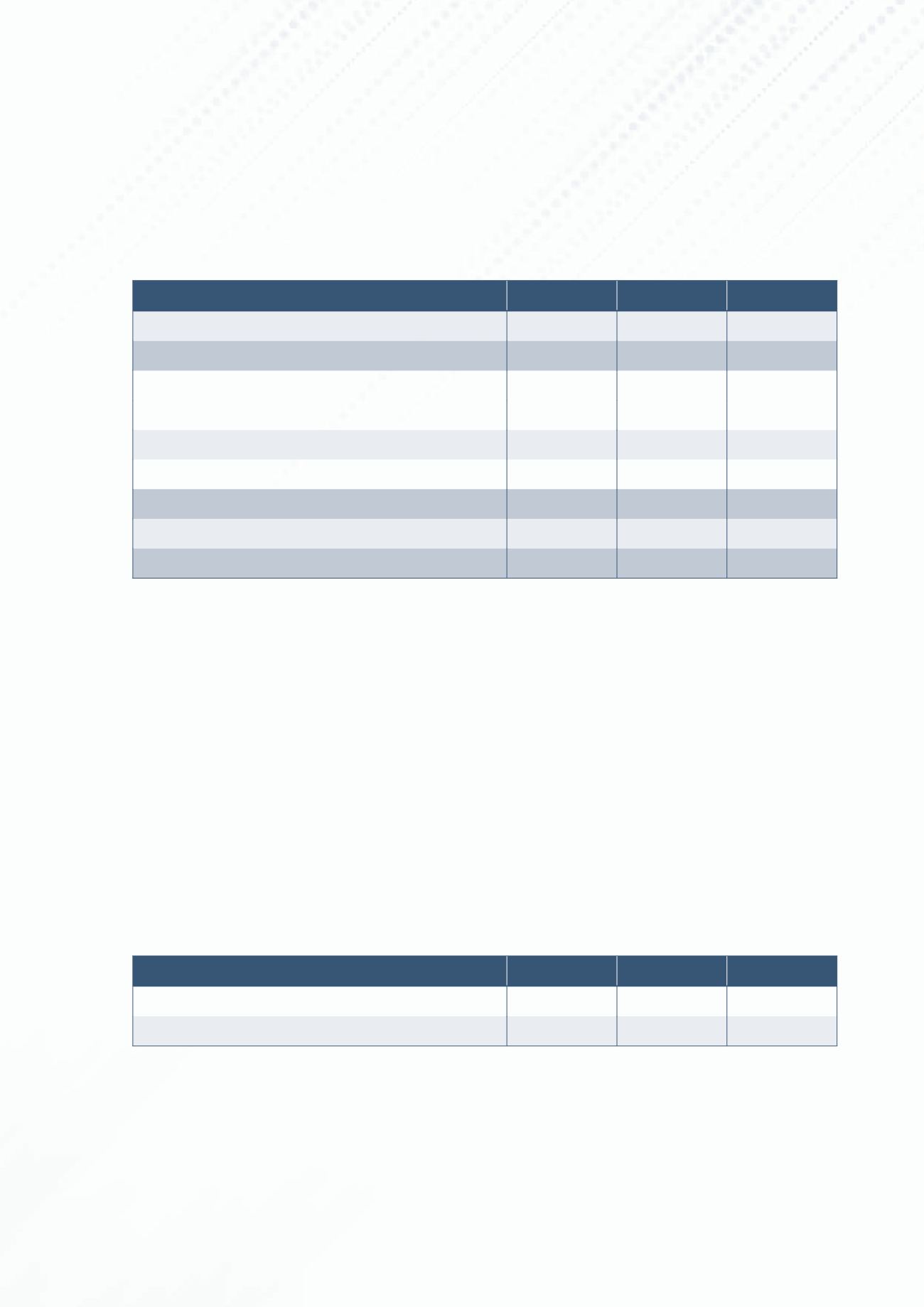

1.0 Operating Results of the Group

In $ million

FY2015

FY2014

Change (%)

Revenue

580.7

516.8

12%

Gross profit

43.1

42.5

1%

Other income

1.2

0.9

33%

Total expenses

(569.1)

(506.3)

12%

Operating PBT

12.8

11.4

12%

Exceptional items

(0.6)

–

nm

PBT

12.2

11.4

7%

PAT

10.0

9.2

9%

PATMI

10.3

9.4

10%

nm: not meaningful

1.1 Revenue

Group revenue increased by 12% or $63.9 million to $580.7 million in FY2015.

Personal Communications Solutions Services (“PCS”)

contributed to 71% of group revenue in FY2015 (FY2014: 71%). Revenue

increased by 13% to $413.7 million in FY2015 due to higher prepaid sales with the appointment as the new master distributor.

These were offset by lower channel sales in Singapore and lower revenue from Malaysia.

Info-Communications Technology Services (“ICT”)

contributed to 19% of group revenue in FY2015 (FY2014: 19%). Revenue

increased by 9% to $109.6 million in FY2015 due to higher enterprise solutions sales and more project completed.

Network Engineering Services (“Engineering”)

contributed to 10% of group revenue in FY2015 (FY2014: 10%). Revenue

increased by 12% to $57.4 million in FY2015 due to higher transmission equipment sales in Singapore, higher revenue recognition

from Radio Network Planning projects and power supply products sales in Indonesia. These were offset by lower revenue from

Malaysia.

1.2 Gross profit

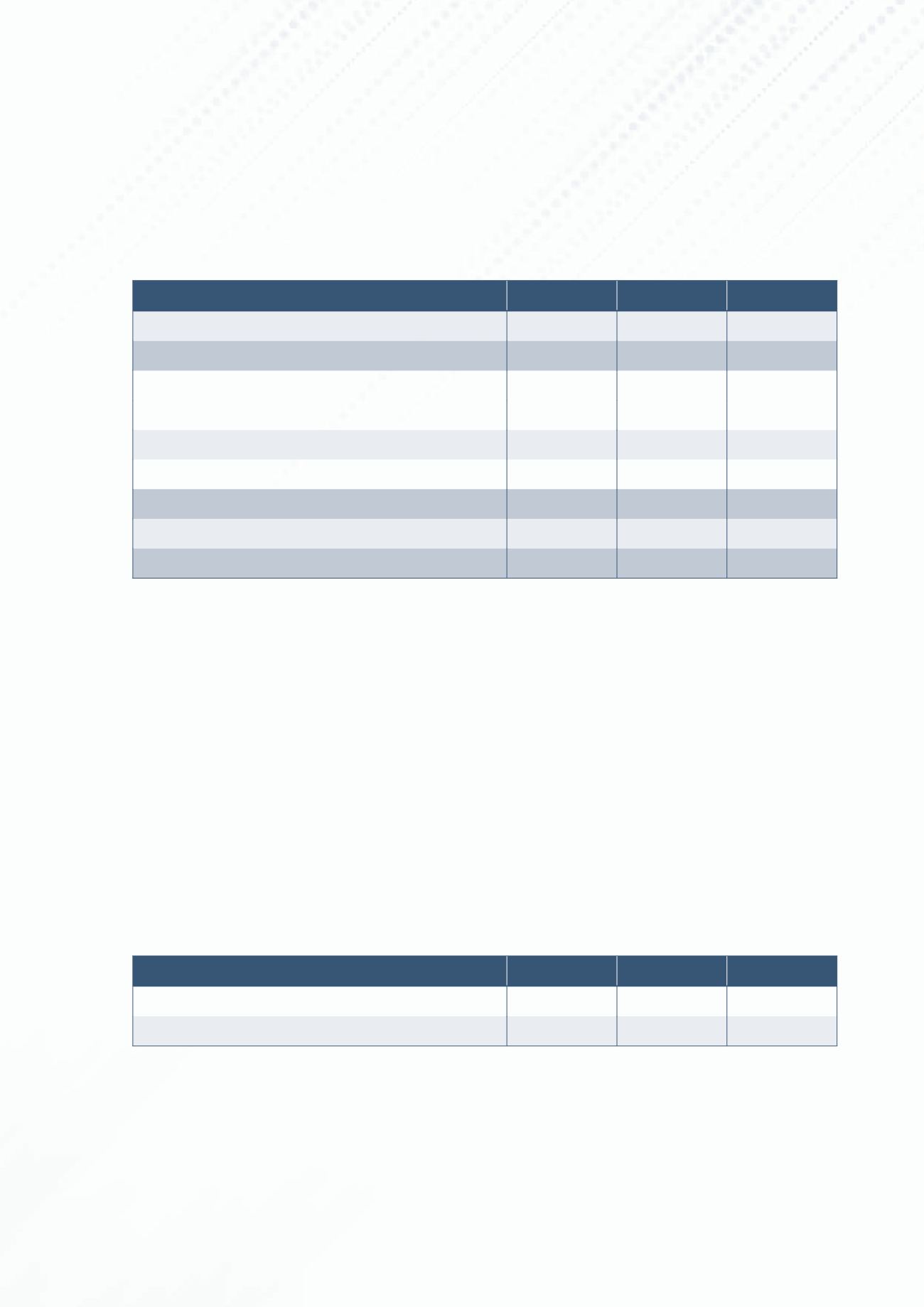

In $ million

FY2015

FY2014

Change (%)

Gross profit

43.1

42.5

1%

Gross margin

7.4%

8.2%

-0.8 ppt

ppt – percentage point

Gross profit

increased to $43.1 million in FY2015. The increase was contributed by PCS.

Gross margins

declined from 8.2% in FY2014 to 7.4% in FY2015. Excluding the zero margin handset sales to a major customer

in Singapore, gross margins would have declined from 12.1% to 10.4% in FY2015. PCS FY2015 gross margin was maintained

at the same level as FY2014. Lower gross margin from ICT in FY2015 was due to sales mix while Engineering’s lower gross

margin was due to weaker performance from its Malaysian operations.