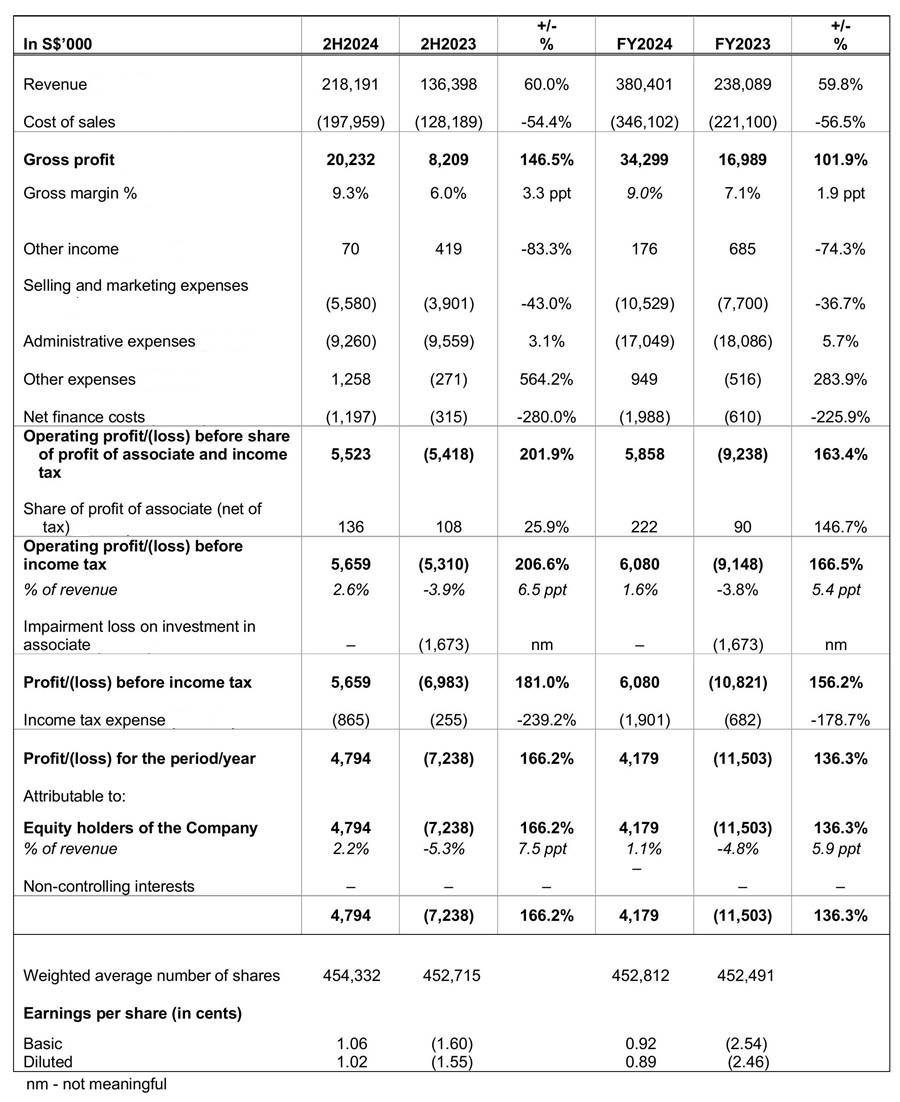

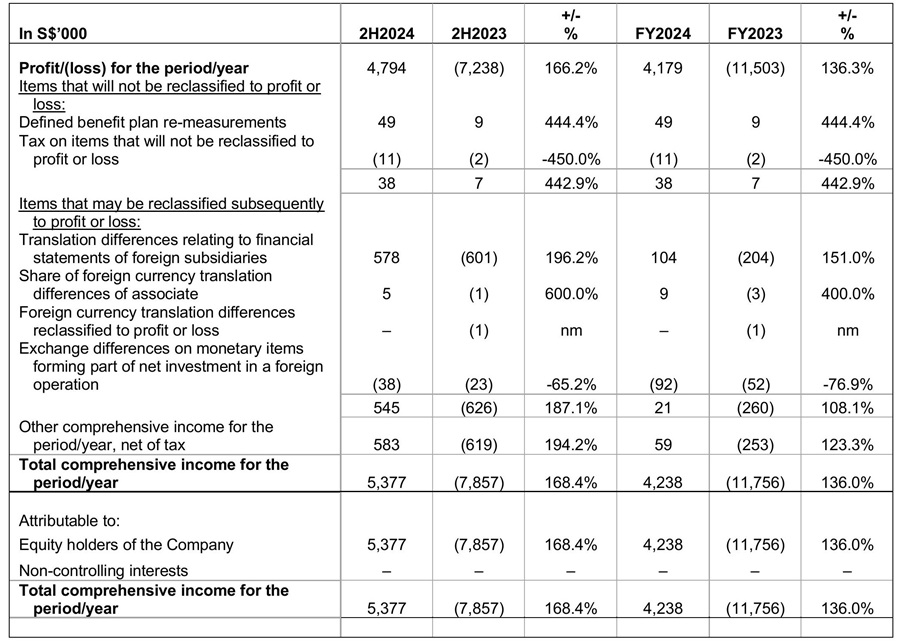

Consolidated Statement of Profit or Loss and Other Comprehensive Income for Financial year ended 31 December 2024

Consolidated Statement of Profit or Loss

Consolidated Statement of Other Comprehensive Income

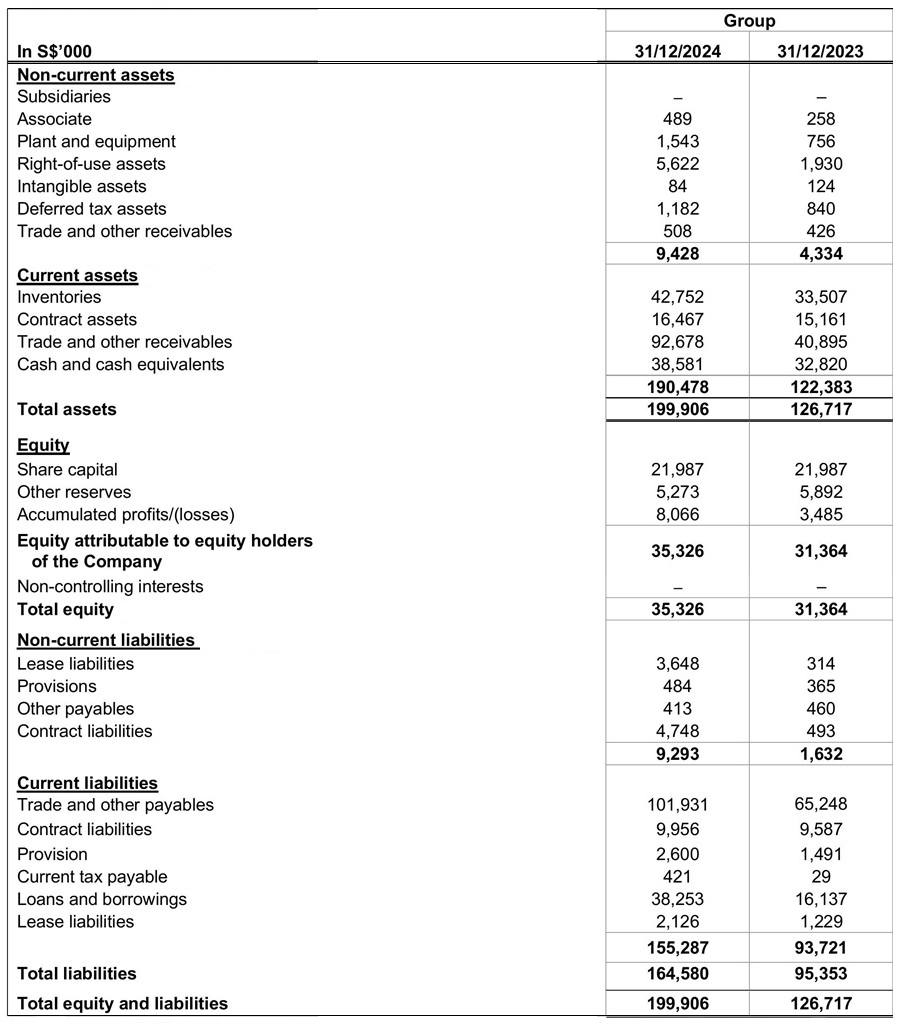

Statements of Financial Position As at 31 December 2024

Review of Group Performance

The Group registered revenue of S$218.2 million in 2H2024, a 60.0% increase as compared to S$136.4 million in 2H2023, on the back of higher revenue contribution from the PCS and ICT Divisions. Against 1H2024, the Group recorded a 34.5% increase in revenue in 2H2024 with an increase in contributions from the PCS and ICT Divisions. Group revenue of S$380.4 million in FY2024 was 59.8% higher than FY2023, with all divisions recording higher revenue in FY2024.

In 2H2024, the Group recorded an operating profit before tax of S$5.7 million as compared to an operating loss before tax of S$5.3 million in 2H2023. The improvement was mainly due to higher revenue and improvement in gross margins in 2H2024. All divisions reported a profit in 2H2024. The Group recorded a higher operating profit before tax of S$5.7 million in 2H2024 as compared to operating profit before tax of S$0.4 million in 1H2024 as all divisions recorded improvement in 2H2024. The higher gross profit in 2H2024 was partially offset by higher sales and marketing expenses and financing costs to support the increase in sales activities for the PCS Division.

In FY2024, the Group recorded an operating profit before tax of S$6.1 million as compared to an operating loss before tax of S$9.1 million in FY2023. The PCS and Engineering Divisions reported a higher operating profit of S$6.6 million and S$0.7 million respectively in FY2024 while the ICT Division recorded a lower loss of S$1.2 million in FY2024.

PCS Division recorded a revenue of S$241.4 million in FY2024, an increase of 116% against FY2023. Profit before tax was S$6.6 million in FY2024 as compared to a profit before tax of S$0.4 million in FY2023. The Malaysian operations continued to be a significant profit contributor and had recorded higher profit before tax due to higher revenue recognised from the recent 4PL fulfilment and managed services contract signed with U Mobile in February 2024. Additionally, there was an exchange gain of S$1.2 million arising from repayment and revaluation of the SGD loan due to its holding company in Singapore. These were partially offset by higher financing costs incurred to finance the increase in working capital requirement to support the increase in sales activities. The Singapore operations breakeven in FY2024 as compared to losses recorded for FY2023 due to higher revenue from its managed service contract with Honor and closure of several underperforming stores.

ICT Division recorded a revenue of S$85.7 million in FY2024, an increase of 12% against FY2023. Operating loss before share of profit of associate and tax of S$1.4 million was reported in FY2024 as compared to an operating loss before share of profit of associate and tax of S$6.3 million in FY2023. This was mainly due to higher revenue and higher gross margin as well as lower staff related costs in FY2024. The significant improvement was mainly from the Communications business recording a profit in FY2024 against a loss in FY2023 after the restructuring was completed in FY2024. IT business recorded a lower loss in FY2024 against FY2023 due to higher revenue recognised by its Digital Infrastructure business. This business secured 2 major orders from the Healthcare and Hospitality sectors. The IT business loss was primarily from its Tech & Apps Services business due to its lower order book secured as well as additional cost incurred to complete certain long-term projects.

Engineering Division recorded a revenue of S$53.3 million in FY2024, an increase of 7% against FY2023. The increase in revenue was from its Singapore operations. Profit before tax of S$0.7 million in FY2024 was recorded as compared to a loss before tax of S$3.3 million in FY2023. The Indonesian operations continued to be the main profit contributor for both periods. The significant improvement against the previous period was mainly attributed to the Philippines operations write off of contract assets resulting from cancellation of orders in FY2023. There were also lower losses recorded from the Singapore operations in FY2024 due to higher revenue recognised from its structured cabling business.

The Group recorded a net cash outflow from its operating activities in FY2024. Operating profit for the year was offset by negative changes in working capital largely attributed to the increase in sales activities from the PCS operations in Malaysia. As at 31 December 2024, the Group’s net cash position of S$0.3 million was lower than the net cash position of S$16.7 million as at 31 December 2023, mainly due to higher bank loans secured to finance the working capital required for the fulfilment of 4PL to U Mobile.

Prospects

The Group returned to profitability in FY2024, continuing its positive growth trajectory, driven by improved revenue. Looking ahead to FY2025, despite an uncertain economic outlook, the telco and ICT sectors in ASEAN are set for growth, driven by AI, 5G, cloud, and cybersecurity initiatives, increasing the need for robust digital infrastructure, including data centers, to support e-commerce and online services. The Group aims to capitalise on emerging industry opportunities. It will continue to enhance operational efficiency, strengthen customer and vendor relationships, and maintain sound financial management, all of which have been key to supporting its recovery. The Group anticipates continued revenue growth in all divisions, requiring additional investment and working capital.

Segmentally, the PCS Division is well-positioned for stable performance. In Malaysia, the focus will be on continuing the 4PL managed services contract with U Mobile, one of the leading mobile operators in Malaysia, expanding the distribution network, and optimising retail outlets to effectively serve both East and West Malaysia. In Singapore, the Division will enhance value-added fulfillment and retail services while further supporting handset principals with improved concept shop experiences to deliver superior customer value. The ICT Division will tap on the rising demand for cloud services and AI solutions, focusing on subscription-based services to secure new contracts and strengthen its offerings. It remains optimistic about growth through AI integration and innovative sales strategies. The Engineering Division will build on its momentum in Indonesia, using its expertise to develop telecom infrastructure, deliver power solutions, and secure managed services and fibre to the home (“FTTH”) contracts. It will continue to expand its offerings and explore new verticals, particularly data centers, while leveraging growth from network operators in both the fixed and mobile sectors.

This release may contain forward-looking statements that involve risks and uncertainties. Actual future performance, outcomes and results may differ materially from those expressed in forward-looking statements as a result of risks, uncertainties and assumptions. Representative examples of these factors include (without limitation) general industry and economic conditions, interest rate trends, cost of capital and capital availability, competition from other companies and venues for the sale/distribution of goods and services, shifts in customer demands, customers and partners, changes in operating expenses, including employee wages, benefits and training, and governmental and public policy changes. You are cautioned not to place undue reliance on these forward looking statements, which are based on current view of management on future events.